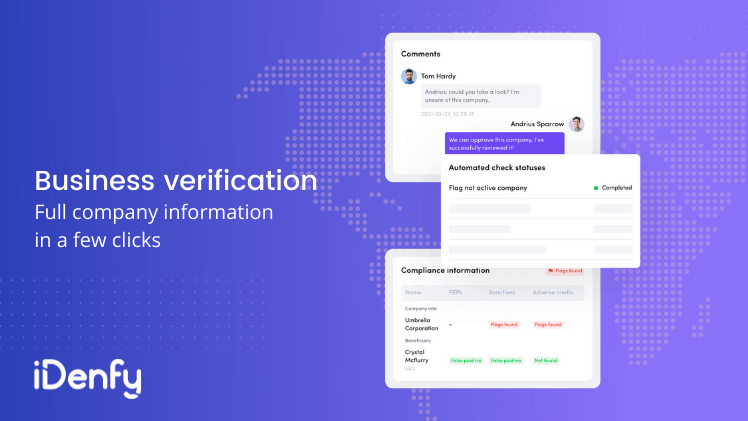

iDenfy’s real-time, single API Business Verification adds an extra layer of protection

4 Mins Read

Published on: 25 May 2022

Last Updated on: 06 September 2024

toc impalement

Kaunas, Lithuania (May 19, 2022) – iDenfy, is a Lithuanian startup that processes digital identity verification and ensures service for fraud prevention.

It developed a fully automated Know Your Business (KYB) platform. By scanning organizations’ profiles, iDenfy’s Business Verification services will help prevent partnering with illegitimate companies and money laundering channels.

iDenfy’s Business Verification services scan company addresses, licensing documentation, registration documents, and identities of directors and owners. With the help of artificial intelligence, iDenfy’s KYB implementation efficiently spots risks or suspicious behavior patterns in business relationships.

This also includes reviewing companies against sanctions lists, checking political corruption possibilities, or seeking other indications that they might be involved in criminal activity.

iDenfy’s CEO Assertion:

According to iDenfy’s CEO, Domantas Ciulde, shell companies are getting harder to detect: “It’s not enough to screen basic information centers and credit bureaus with the hopes to catch money launderers. Experienced criminals create their cover by buying companies that already have a history.” Ciulde explains that fraudsters try to go undetected by managing complex governance schemes in different countries at once.

iDenfy’s goal is to ensure quick and accurate detection of illegitimate companies. The company used several new algorithms, which help identify automatically whether a company is fictitious or real without using expensive resources.

One of the algorithms from iDenfy inspects how well the company’s website is designed, how much information it provides, how popular it is in the local and international markets, how many times the website is mentioned online, and what content is uploaded there.

iDenfy’s Business Verification services also review the company’s social media channels. The new software helps distinguish large numbers of fake companies based on their online presence. “Most fraudulent companies simply try not to provide information on their website. By doing so, they increase the suspicion,” – says Ciulde.

Although some companies stick to the rules, there’s a chance that the other party is not in compliance. According to the CEO of iDenfy, conducting a proper investigation in the fastly-moving Business-to-Business (B2B) sphere is crucial.

That’s why the goal of the new Business Verification process is to determine whether the business entities are authentic or are being used to conceal the identities of owners due to criminal behavior.

Some businesses do not manage the risks to their reputations or only focus on handling threats to their reputations that have already surfaced, which, according to Darius Suite, iDenfy’s Chief Business Development Office, isn’t risk management – it’s already a crisis that can be avoided.

The specialist emphasizes that the new Business Verification services quickly analyze the collected information in real-time, automatically detecting the risks of business relationships.

A notorious example exposing the potential risks behind a business is the Panama Papers. The scandal showed the behind-the-scenes of gaps in the legal system and how some corporations and high-profile businesses try to avoid regulatory requirements. The data breach of more than 11.5 million legal and financial documents uncovered hidden issues of corruption and crime, containing fraud, avoidance of sanctions, and tax evasion.

With such dangerous factors in play, a more in-depth analysis evolved, as many businesses from various industries combine the two-layer security of Know Your Business (KYB) and Know Your Customer (KYC). iDenfy claims to offer Business Verification solutions with “everything you need” in one API.

According to Darius Sulte, the Business Verification services’ framework is much more than the standard risk assessment of money laundering and terrorist financing because it faces the most important aspect in terms of business and the relationships with customers or partners.

“Even though there are similar solutions in the market, manual business verification checks lose the battle with automated Know Your Business services due to potential threats of human error, not to mention the time and costs. We’re proud to have developed a smart and efficient way to ensure every company’s safety when forming business relationships.” – expressed Domantas Ciulde.

About iDenfy

identify is a platform for identifying the verification services and identify the fraud prevention tools. It provides an authentic AML and KYC compliance for each large-scale company to small organizations. The rapidly growing business was named the best “Fintech Startup” of 2020. This company was also acknowledged with the Baltic Assembly Prize as the recognition for winning in 2021.

For more information and business inquiries, please visit www.idenfy.com

Read Also:

Easy Ways To Cut Business Costs In 2022

Five Things to Consider When Starting an HVAC Business

Local Small Businesses: Here Are 4 Ways to Generate Leads For Your Business

What Is The Difference Between A Personal And Business Checking Account?

Comments Are Closed For This Article