Payday Loans eLoanWarehouse: Debt Or A Trap?

30 October 2024

7 Mins Read

toc impalement

Taking out loans is probably one of the easiest things you can do in today’s economy. Countless organizations have come up with their own schemes and loan programs. As a result, more and more people are using them for personal use.

One such program is payday loans. Payday loans are generally short-term loans that incur a high interest rate. These loans are called payday loans because the amount is equivalent to your next paycheck.

Payday Loans eLoanWarehouse is one of the most prominent ways of getting fast and easy cash without hassle. However, this does not mean you must pay no hidden prices. In this article, we will look at some of the most important and alarming factors that you need to know about.

What Is A Payday Loan?

Payday loans can usually range from $100 to $1000. Therefore, you can avail yourself of this loan as per your wants and requirements. As a result, this adds to their sense of convenience, which most other loans lack with their fixed lending cap.

These loans are perfect for getting quick cash. However, these loans come with very high interest rates. As a result, it is often categorized as a form of predatory lending where lenders charge very high interest rates and run the risk of initiating a vicious debt cycle.

Then again, why are these loans so popular among the working class? Let us stick around to know more.

Purpose of Payday Loans

Payday loans are usually short-term and come with a high interest rate. These loans are a great source of quick cash in your hands. However, the high interest rate is the caveat.

These loans are primarily taken out in an emergency. In other words, situations that compel an individual to take out cash. As a result, banks and organizations have kept this form of lending easy and quick.

Moreover, payday loans are usually given out even if an individual has a bad credit score. Therefore, this is one of the reasons that banks provide for charging high interest rates.

As a result, these loans are perfect for those rainy days. Otherwise, there is no point in paying heavy interest rates for loans.

Understanding Payday Loans By eLoanWarehouse

Several different companies offer payday loans. However, today, we will focus on Payday loans by eLoanWarehouse. eLoanWarehouse is a private lending company that has gained prominence recently.

In fact, it is one of the more prominent names in the private lending landscape of the United States Of America. eLoanWarehouse has been actively trying to bring in lenders and borrowers close.

Moreover, the company claims that it aims to simplify the procedure of taking out loans. So that more and more people have access to quick and easy cash. The best part about the company is that the overall design of the platform beautifully replicates that.

Other than that, Payday Loans eLoanWarehouse works just as other payday loans. You can take out easy cash but might pay heavy interest rates.

Eligibility of Payday Loans By eLoanWarehouse

Just like any other lending organization, eLoan WareHouse has defined and absolute eligibility criteria that every lender needs to fulfill. Otherwise, they will not be given out loans.

This is probably because the company provides payday loans with bad credit and without documentation.

Therefore, if you fall under this category, then you need to have a clear idea about the eligibility criteria for Payday loan eLoanWarehouse:

- Age Requirement: The borrower must be legally 18 years old and not younger.

- Income Verification: The borrower must present credible documents stating their steady income source.

- Bank Account: The applicant must hold a valid bank account. This account becomes important for loan disbursement.

- Residency: The applicant must have a permanent residency in the United States Of America.

These are some things that an applicant and the borrower need to remember if they plan on taking out payday loan eLoanWarehouse in the near future.

So, you might have a bad line of credit. Still, you must present these documents to get to the next stage.

The Application Process of Payday Loans eLoanWarehouse

Getting your loan disbursed is not just about being eligible. In fact, it is also about the correct application process. Without the proper application process, you risk getting your application rejected.

Therefore, the next thing you need to do is go through the application process correctly. This is quite important to know the correct way to apply for a loan. This section is all about that.

Here is the correct means of applying for payday loans from eLoanWarehouse:

- Visit the Website: Once you assess your eligibility, you should start the application process. To do this, you need to start by visiting the website. When you get to the website, fill out the application form.

- Necessary Details: Fill in all the details that you are being asked for. These include name, address, residence, etc. Be very precise about these details.

- Submit the Form: Once the form is filled out, you can start the submission process. Make sure to submit the form in a submit-for-review format.

- Wait: Once you submit the form, you must wait for approval. This approval might take some time. However, in most cases, the money and the approval come in under 10 minutes. However, the dispensing time depends on the server and some other factors.

This is the long and short application process for payday loans at eLoanWarehouse. However, you must remember that banks and lending organizations usually update the loan application process. Therefore, keep your eyes out for any sort of updates.

How Does It Work?

Since you are considering taking out a payday loan from eLoan Warehouse, you need to clearly understand how it works. This might not change how you approach the whole deal.

However, knowing how things work when money is involved is always important. Therefore, here is a small rundown of how payday loan by eLoanWarehouse works:

- The first part of the process is the application process. This is where borrowers feed the necessary details, including bank statements, address proof, etc.

- The second part of the process is called the approval stage. This approval stage is about awaiting approval after the application stage.

- The third stage is called the disbursement stage. Applicants or borrowers receive their money at this stage. This could take around one business day or a matter of minutes.

- The final step of the whole process is the repayment stage. In this stage, the bank expects the borrower to clear the debt.

So, this is how payday loans operate. Therefore, you must go through this process to clear the debt.

Advantages & Disadvantages of Payday Loans By eLoanWarehouse

Borrowers often forget that the loan process is over once the money is disbursed. In actuality, this is not the case. A loan is a huge responsibility. Therefore, having a clear idea of the advantages and disadvantages is very important.

In this section, we will be looking at some of the advantages and disadvantages that you need to remember if you are planning on availing yourself of payday loans. Here they are:

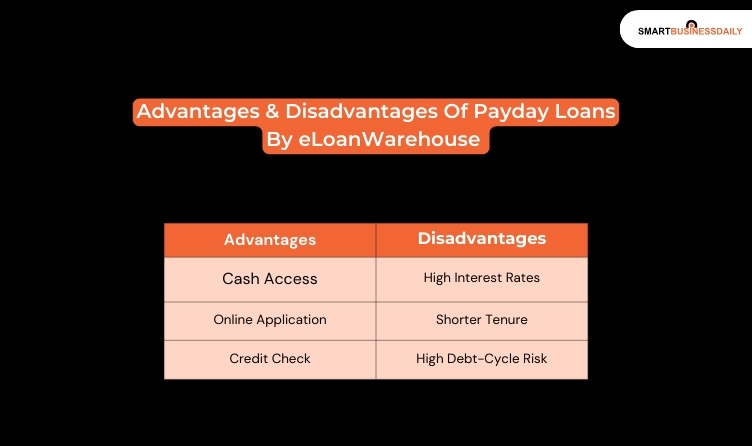

Pro- Cash Access

Payday loans usually work in a fast cash disbursal format. This means applicants or borrowers can get the money in under one business day. Therefore, they are perfect for emergency cash situations.

Con- High Interest Rates

These loans are great for emergencies due to fast cash disbursal. However, they come with a huge interest rate. As a result, paying them off can become quite a hassle. This can pose huge difficulty in the long run.

Pro- Online Application

Applying for these loans is quite hassle-free. You can easily apply for these loans from anywhere. Most of these loan applications are done via the Internet. Therefore, they are easy to apply and hassle-free to a great extent.

Con- Shorter Tenure

These loans are usually created in a short repayment format. This means the lending organization would give you a tenure of one or two months to pay the loan off. This can be a huge challenge for someone who might have taken the loan out for a medical emergency. Then, it would be difficult if they were already taking up medical expenses.

Pro- No Credit Check

In most cases, people gravitate toward payday loans eLoanWarehouse when they have a bad credit score or an instant need for money. Therefore, institutions usually do not undergo extensive background checks or credit checks. This makes the loan more accessible.

Con- High Debt-Cycle Risk

These loans come with high interest rates and short tenure. This is the most dangerous combination for people to fall into the debt cycle. This can prove dangerous for people as it can lead to bankruptcy or financial failure. Both of which are horrible and can be devastating.

The End

In summation, payday loans eLoanWarehouse is a great way to help yourself financially. However, there are some blatant caveats that you need to understand and know. Otherwise, momentary help can turn into a lifelong problem.

Therefore, keep an open mind and weigh all your options before committing. Otherwise, things can turn out really problematic in the long run. Follow us for more such content on wealth and business management.

Read Also:

Comments Are Closed For This Article