Penny Stocks For Beginners: Best Stocks For Beginners With Little Money

20 January 2025

7 Mins Read

toc impalement

Investing in the stock market can be an excellent way to grow your wealth. However, it may seem daunting for beginners, and that too with a bit of funding. You might think, “Where do I start?” or” What are the best stocks for beginners with little money?”

The stock market is more like a platform where you can sell shares of publicly traded companies. If you don’t have such a type of company, in that case, you can just buy shares.

This stock market provides you with the opportunity to own successful businesses and gain benefits from their growth partially. Saying this from my own experience but investing in stocks is essential. It can help you to cope with inflation. You can earn money to save for long-term growth.

On the other hand, it also offers potential higher returns. Suppose you compare it with traditional savings accounts. However, you just need to ensure that your chosen stock is properly aligning with your financial goals.

Here in this blog, I will help you find some of the best stocks for beginners with little money. Other than that, I will also help you to understand the types of stocks that are available for you, along with the factors that can help you choose the right stock for you.

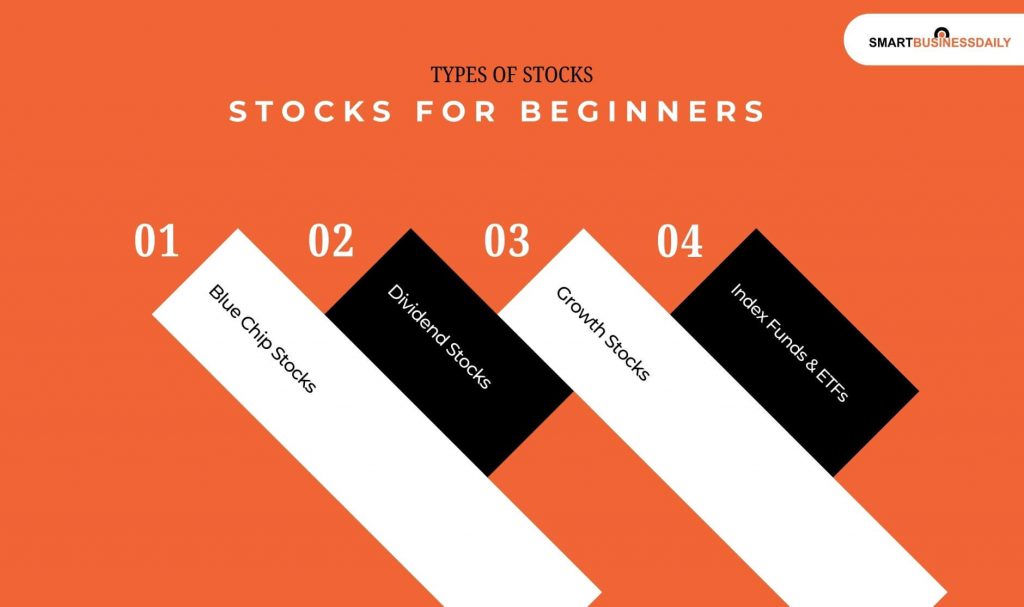

Types Of Stocks For Beginners

Here in this section, I am going to discuss the best stocks for beginners with little money. Understanding these will be useful for novice investors who have minimal capital. Read on…

Blue Chip Stocks

The Blue chip stocks mainly represent shares of the companies that are large and very well established. These companies also have a history of stable performance. On top of that, these large companies are more like leaders in their own industries.

So, as a beginner, blue chip stocks can be very reliable for you. They can offer you better reliability and lower volatility than any other small company can ever do.

Investing in a blue chip stock helps beginners to own a piece of companies that has a proven record. Yes! Large companies do not always show high growth. Instead, they often offer you regular dividend payments and steady growth that can be helpful for your investment journey.

Dividend Stocks

The dividend stocks are the company shares that distribute a portion of their earnings to the shareholders. This can be on a regular basis or typically on a quarterly basis. The Dividend stocks are very appealing to beginners. It provides you with a very steady income as well as potential capital appreciation.

Now, if you are an investor with very limited funds, don’t worry! Dividend stocks can offer you tangible returns on investments. On top of that, it can also help you accelerate your portfolio through compound interest.

Growth Stocks

The growth stocks mainly depict the companies that are expected to grow at an average rate. You may find these companies very innovative and expanding rapidly. However, these growth stocks can be volatile compared to the blue-chip or dividend stocks, they offer better capital appreciation.

If you are a beginner with high risk tolerance and long term investment, in that case, the growth stock can be perfect for you! This stock option can provide you with good exposure to cutting-edge technologies and a substantial return.

Index Funds & ETFs

Index funds and exchange-traded funds– both of these cannot be considered individual stocks. However, you can say it is a collection of stocks that track a specific market index or a particular sector.

These two investment types can offer you an easy way to achieve instant diversification, which is very crucial to managing your risks. Thus, index funds and ETFs can be desirable for those who are planning to invest with little money. But do you know the best part? These two approaches help to simplify your process, which further reduces the overall need for extensive research.

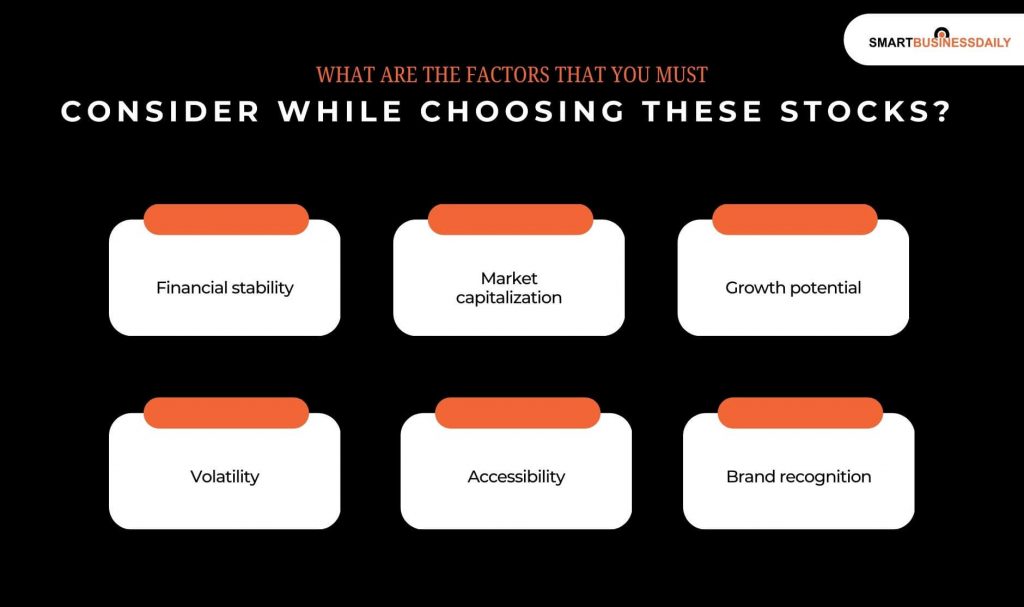

What Are The Factors That You Must Consider While Choosing These Stocks

When you are evaluating stocks with very minimals, these are the keys that you must consider:

Financial stability: Look for companies that hold robust balance sheets and better consistency in the overall revenue growth.

Market capitalization: The preferences for large capital stocks always come in a more stable way.

Growth potential: Try to evaluate the prospect of the company along with the industry trends.

Volatility: Try to look for stocks that have a lower rate of price fluctuations. This will help to make significant emotional decisions.

Accessibility: Always remember that the sticks have a pretty low price. This will allow you to get easier entries for limited funds.

Brand recognition: The well-known companies are easier for the beginner to understand and follow.

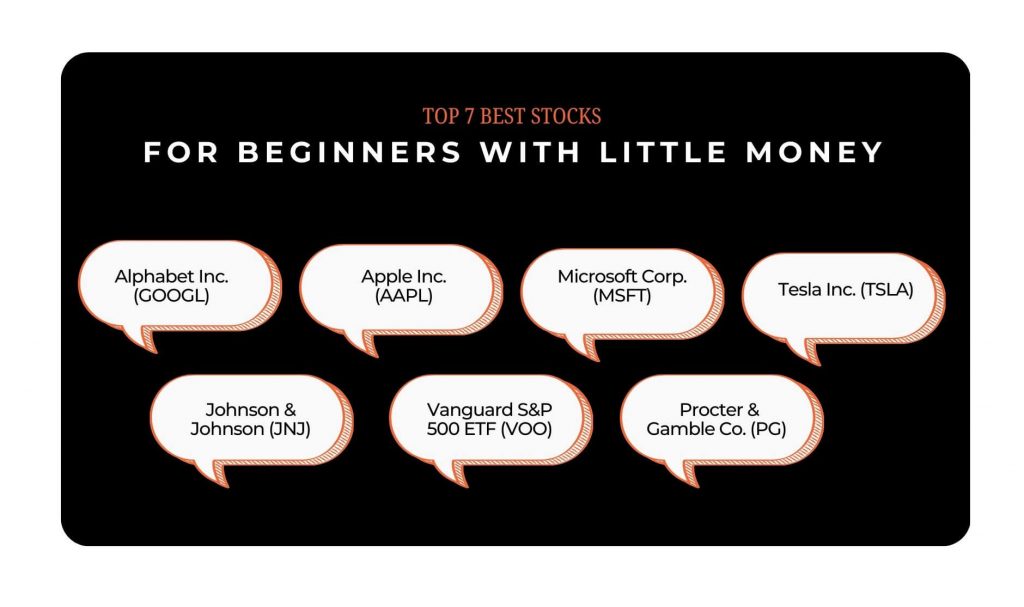

Top 7 Best Stocks For Beginners With Little Money

Investing in stocks is an excellent way to grow your money, even if you’re just starting out with a small budget. However, finding stocks that are both affordable and reliable can be overwhelming for beginners.

In this section, we’ll look at seven great stocks that are perfect for those with limited capital who want to get their feet wet in the stock market.

Alphabet Inc. (GOOGL)

Alphabet is the parent company of Google, the dominant search engine on the Internet. With a market capitalization of over $1.5 trillion, it ranks as one of the largest companies across the globe.

In the latest reports, 2023 revenues reached a little under $280 billion for Alphabet, with $59 billion in net income.

Why It’s Perfect for Newbies:

Google is a household name and a leader in the tech space. It’s a stable, high-growth company with a consistent track record of profitability.

The stock price is relatively stable, so it would be a safer bet for new investors. Alphabet’s stock price is relatively affordable (around $100–$150), making it accessible for beginners with small budgets, even though it is highly valued.

Apple Inc. (AAPL)

Apple is one of the world’s most valuable companies, known for its iPhones, iPads, Macs, and other devices.

With a market cap of nearly $2.7 trillion, Apple generated $394 billion in revenue in 2023, with a net income of $99 billion.

Why It’s Great for Beginners:

Apple is a blue-chip stock—large, stable, and with a strong reputation. It generates incredible amounts of profit every quarter, which is perfect for a beginner looking for a long-term growth stock with almost zero risk.

Its stock price is high but regularly splits to become affordable, always being a safe bet in the world of tech.

Microsoft Corp. (MSFT)

Another tech behemoth in existence for multiple decades, Microsoft deals in software solutions, cloud services, and hardware.

Microsoft has a market cap of approximately $2.5 trillion, an annual revenue of $211 billion in 2023, and a net income of $72 billion.

Why It’s Ideal for Beginners:

Microsoft stands out as a strong option because it is well-established, and its diversified business model assures constant growth.

This stock has a relatively stable growth pattern. Thus, it’s perfect for those beginners who seek stability in the tech sector. Despite its price, Microsoft has been known to provide dividends, offering added value for investors.

Tesla Inc. (TSLA)

Tesla, under the leadership of Elon Musk, is at the forefront of electric vehicles and renewable energy solutions. The company has a market cap of approximately $900 billion, with revenues crossing the $80 billion mark in 2023 and a net income of $12.5 billion.

Why It’s Perfect for Beginners:

Tesla has a mix of high-risk, high-reward potential that could be pretty attractive to a beginner investor who can stomach a little bit of volatility. As the world continues its move towards electric vehicles, Tesla has positioned itself well to benefit from this growth.

While it’s a more volatile stock, its long-term prospects could make it an exciting opportunity for new investors looking for growth.

Johnson & Johnson (JNJ)

Johnson & Johnson is a healthcare leader in the production of pharmaceuticals, medical devices, and health products for consumers. It has a market cap of over $400 billion, with a revenue of $102 billion in 2023 and a net income of $19 billion.

Why It’s Perfect for Beginners:

With a solid dividend yield and a track record of consistent earnings, Johnson & Johnson is the perfect stock for beginners seeking a safer investment with a longer time frame.

Healthcare is relatively recession-proof, and JNJ provides stability, growth potential, and passive income through dividends, perfect for cautious investors.

Vanguard S&P 500 ETF (VOO)

This is not a single stock but an exchange-traded fund (ETF) tracking the S&P 500, a basket of the 500 biggest U.S. companies. The market cap of the fund is around $350 billion, and it pays out 1.5% yearly in dividends.

Why It’s Ideal for Beginners:

The Vanguard S&P 500 is an excellent way to diversify instantly for beginners with little money. Instead of buying individual stocks, you are investing in a basket of already well-established companies that reduce risk.

VOO offers a low-cost, low-risk way to invest in the overall U.S. stock market and would be perfect for one just starting to build their portfolio.

Procter & Gamble Co. (PG)

The company Procter & Gamble is known for being a goods company for consumers with well-known brands like Pampers and Gillette. It has a market capitalization of approximately $400 billion, with revenue of roughly $88 billion in 2023 and a net income of $13 billion.

Why It’s Perfect for Beginners:

P&G’s consistent performance and dependable dividends make it an excellent stock for new investors. It operates in the consumer goods sector, which tends to be more stable during economic downturns. The ability of P&G to generate consistent revenue from everyday products means it is a reliable long-term investment for beginners looking for passive income.

Final Words!

Stock investing doesn’t require a ton of cash to get started, especially when you pick the right companies. The seven stocks listed here are great for beginners since they bring a mix of stability, growth, and affordability.

Be it well-established companies like Apple and Microsoft or something with just a little more potential for growth like Tesla—there’s something for every kind of investor.

Always do your own research and invest based on your own risk tolerance and financial goals. Happy investing!

Related Post:

Comments Are Closed For This Article