How to Borrow Money from Cash App Without Limits In 2025?

25 February 2025

7 Mins Read

toc impalement

The Cash App Borrow program refers to an innovative facility that allows selected users of the Cash App platform to borrow short-term loans directly through the Cash App.

This facility has been engineered to provide quick and easy access to funds in emergencies or unexpecting financial situations.

The Cash App Borrow feature is not available to all users, as the eligibility criteria are based on credit history, activity and account, and state regulations.

Cash App Borrow generally enables a limited borrowing amount of $20 to $200 that comes with a repayment time and set fees.

This is very helpful in comparison to regular payday loans, with fewer hassles and a great difference in cost when it comes to accessing funds for a very short term.

Unlike traditional banking loans, which require many documents to be fulfilled, the Cash App Borrow feature makes it convenient by providing it within the app. It allows the customer to apply, approve, and receive funds in only a couple of minutes.

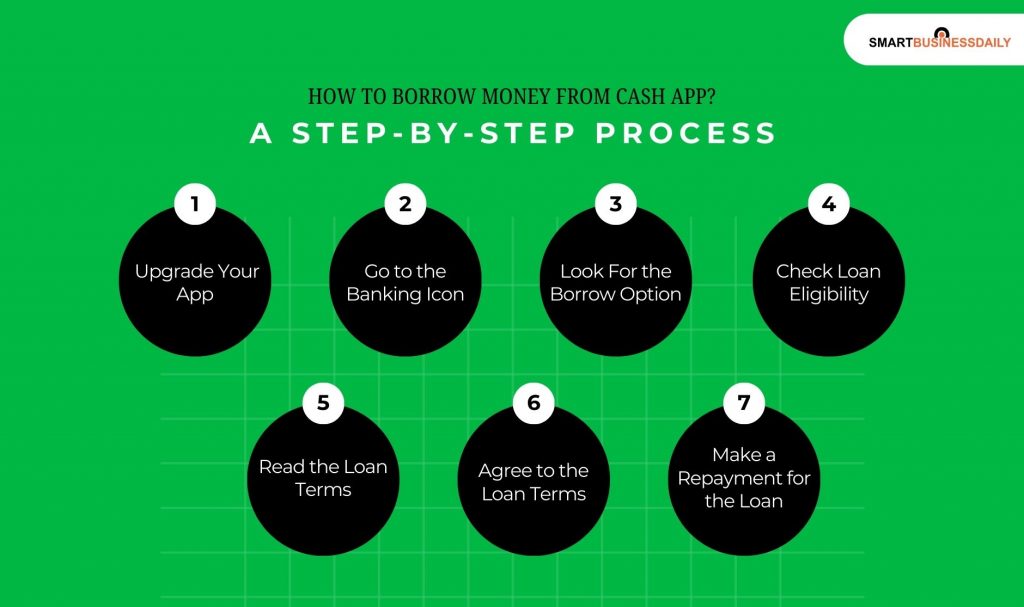

How to Borrow Money from Cash App? A Step-by-Step Process

If you want to learn how to borrow money with Cash App, here are steps to check eligibility and request a loan:

Step 1: Upgrade Your App

Remember to upgrade your Cash App before trying these steps. Open the Cash App and enter your safe details to log into your account.

Step 2: Go to the Banking Icon

To enter the app, hit the Banking icon (formerly the “Balance” tab) at the bottom left of the screen. Under this are all the cash app financial services, with borrowing options available if the user is eligible.

Step 3: Look For the Borrow Option

Scroll through the banking options available to you in the section. If the ‘Borrow’ feature is available, it will appear here. If you do not see this option, you may not currently qualify based on Cash App’s eligibility criteria.

Step 4: Check Loan Eligibility

Tap “Borrow” to find out the amount for which you qualify. Cash App will analyze your account activity and determine what amount you can borrow based on your transaction history, direct deposits, and overall financial behavior on the app.

Step 5: Read the Loan Terms

Read the borrowed amount and the associated interest, fees, and repayment schedule. It is important to understand these details before proceeding. Ensure you meet the repayment terms to avoid adding costs or being potentially restricted from the account.

Step 6: Agree to the Loan Terms

If you agree with all terms and conditions, go ahead and accept the loan offer and confirm requesting the loan. The loan amount will be deposited in your Cash App balance right away (or in a very brief time). Then, you can send the funds to your linked bank account or use them for direct transactions within Cash App.

Step 7: Make a Repayment for the Loan

Make repayments on time per the timetable to avoid extra fees and stay qualified to borrow again. Cash App may have the scheduled due withdrawal from your balance or linked bank account.

Qualification for Cash App Borrow?

Not all users are allowed access to the Cash App Borrow feature. To improve the chances of being qualified, here are some factors that can be considered:

1. Active Cash App Account

The account should be in good standing and recently active in various transaction activities, such as payments, transfers, and deposits.

2. Frequent Direct Deposits

The likelihood of loan application approval is generally higher for users who receive direct deposit payments into their Cash App account from at least a few different paychecks or repeat sources.

3. Good History

An excellent transaction history, including sending and receiving money, making purchases, and actively using the account, can increase the chances of approval.

4. Your location

Cash App Borrow is not available in all states due to regulatory restrictions. If you are not eligible, it could be due to state laws.

5. Creditworthy

Since Cash App does not ask for a traditional credit check, it may rely on other internal needs using certain transaction behaviors and possibly the creditworthiness of financial behavior.

How Cash App Loans Work

Understanding Cash App Borrow is beneficial for users’ decisions before borrowing. This is how the loan process works:

1. Loan Amounts

Cash App usually offers loans ranging from about $20 to $200; an amount based on eligibility must be established.

2. Fixed Repayment Terms

Loans must be paid before the end of a specified period, usually four weeks, but some exceptions apply.

3. Interest and Fees

A fixed percentage fee applies to borrowed amounts that must be repaid with the principal. Reviewing these fees is essential before accepting a loan.

4. Repayment Methods

Funds can be repaid using the Cash App balance, linked bank account, or debit card.

5. Late Payment Consequences

Missing payments would result in extra fees, a cap on balances available for borrowing, and possibly restricted access to your Cash App account.

Benefits of Using Loans with Cash App

Cash App borrowing has advantages over the traditional lending process.

- Instant: It is quick; one can borrow money and instantly have it available once approved.

- No Traditional Credit Check: In such a situation, the short-term loans one gets do not affect one’s credit score at all.

- A simple Application Process: Involves less paper and approval processing with the cash app.

- Flexible Repayment: Users can use the Cash App balance or authorized bank account to repay their loans.

- Better than Payday Loans: Cash App Borrow is a better alternative to payday loans at very high rates. It would be safer to use it to fulfill short-term obligatory financial needs.

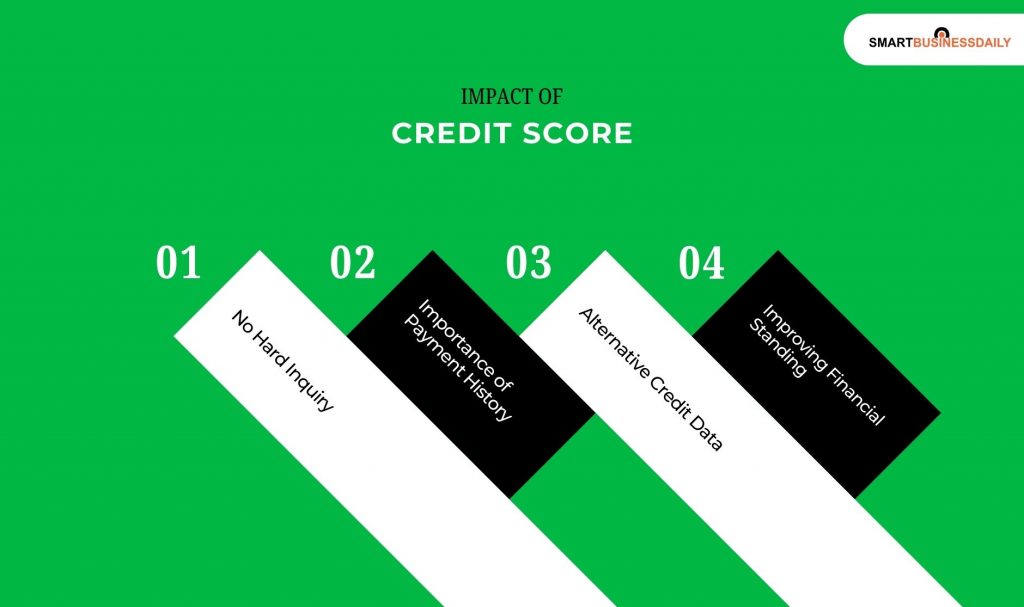

Impact of Credit Score

Cash App Borrow will not conduct a formal credit check, but it does have credit considerations:

1.No Hard Inquiry

Cash App does not lay a hard inquiry on your credit report, thus not affecting your credit score.

2. Importance of Payment History

Not paying loans would affect your chances of future borrowing from Cash App Borrow and other lenders.

3. Alternative Credit Data

Perhaps some lenders would consider the amount of transactions made with Cash App when deciding to approve future credit applications.

4. Improving Financial Standing

Paying loans on time shows financial responsibility and thus will likely improve future loan offers.

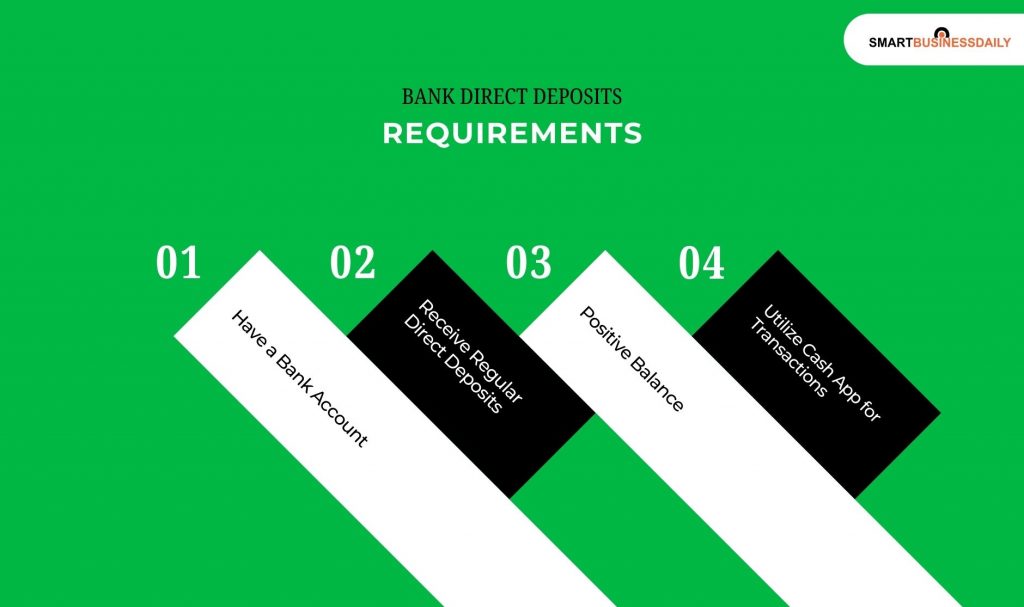

Bank Direct Deposits Requirements

Users must also meet certain banking and direct deposit requirements to qualify for borrowing.

1.Have a Bank Account

Having a linked bank account is important for fund transfers and repayment of the borrowed amount.

2. Receive Regular Direct Deposits

A person who makes direct deposits at Cash App every month will expect to lend more than those who have not made any direct deposits.

3. Positive Balance

A healthy balance and not exceeding overdrafts increases one’s chances of being considered for borrowing.

4. Utilize Cash App for Transactions

Regularly using the Cash App for payments, bill payments, or purchases can go a long way toward improving borrowing chances.

Final Verdict

Cash App Borrow is a helpful feature that allows users to access money quickly for their short-term financial needs. If you are wondering how to borrow money from Cash App, it is very easy.

The loan process is user-friendly, but borrowers should know their repayment terms, eligibility criteria, and any necessary fees before proceeding.

Users should actively use the Cash App, receive regular direct deposits, and maintain a positive account history to increase eligibility.

Nominally, rejecting an application through Cash App Borrow does not affect traditional credit scores, but paying in time remains critical to continued access to future loans.

It ensures responsible borrowing to keep this utility within reach, avoiding unnecessary financial burdens.

Cash App Borrow can be a convenient feature for people who need small, short-term loans when they qualify.

READ MORE: