Choosing the Right Loan Term: Short vs. Long-Term Loans with TraceLoans.com

27 February 2025

7 Mins Read

toc impalement

Need a hassle-free method of obtaining the correct loan? Traceloans.com can assist you. This user-friendly website makes it easy to obtain a loan in simple terms. Whether you need a student loan, automobile loan, home loan, or assistance with traceloans.com bad credit loans? Traceloans.com matches you with suitable lenders.

No complicated jargon or concealed information – just straightforward assistance to guide you to making the correct choice.

Ready to find out your options? Let’s see how Traceloans.com makes lending easy and convenient!

What Is Traceloans.Com?

Traceloans.com is an online platform. The makers are dedicated to simplifying the entire loan process. On top of that, the topics are very easy to understand.

The platform maintains its transparency. So you can easily reply to the information they provide. The platform does not hide a single thing and further assists you in getting a suitable loan for yourself.

Moreover, the platform provides you with information about various loan options. So, you can choose, according to your needs, whether you need a student loan, an auto loan, or a mortgage.

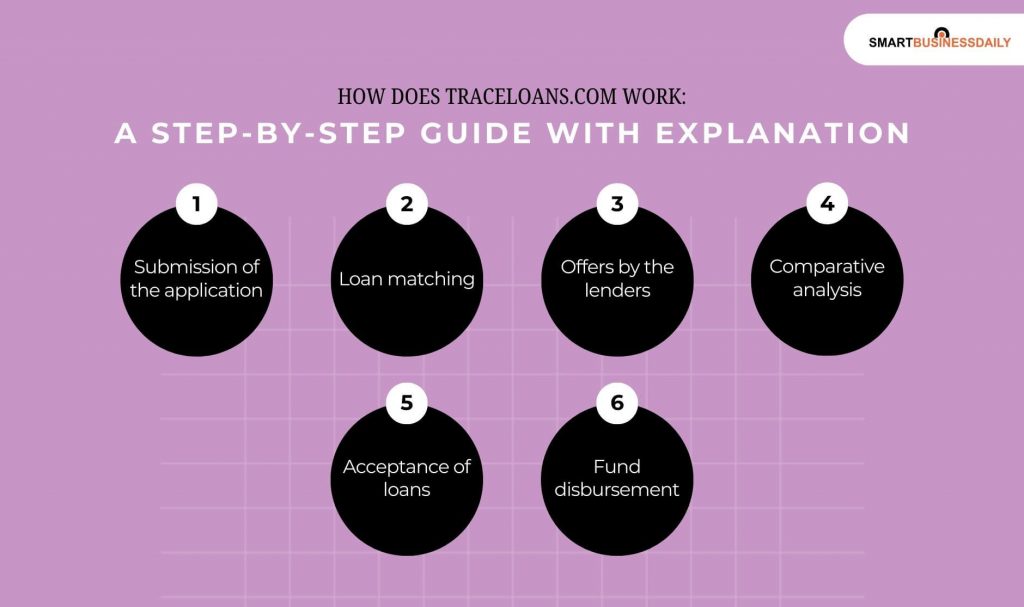

How Does Traceloans.Com Work: A Step-By-Step Guide With Explanation

Imagine traceloans.com as a bridge between loan borrowers and lenders. Here’s how it actually works!

Submission of the application: Users initiate the process by completing the online application forms. Here, you must provide all the basic requirements, such as personal information, the amount you need to borrow, and other financial details.

Loan matching: Next comes the loan matching. Once you are done applying, traceloans.com helps you find potential lenders who meet your needs based on your income, credit score, and other criteria.

Offers by the lenders: Let’s say you have the perfect match for the loan; what’s next? Well, you will receive the loan offer from various lenders.

The decision is upto you! You have to look for their interest rates, the repayment terms they are offering, and other fees associated with the loan.

Comparative analysis: Traceloans.com teaches you to review and further compare all the offers. This plays a huge role in making informed decisions based on financial capacity and preferences.

Acceptance of loans: once you choose an offer, you can proceed with the lender and finalize the loan agreement. The lender might require you to provide some additional documents.

Fund disbursement: Once your loan is approved, the loan amount is further transferred directly to the borrower’s bank account. This only takes a small amount of time.

How To Apply For A Loan On Traceloans.Com

The platform traceloans.com does not provide any loan itself. However, it can connect you with all the potential lenders who can give you loans.

You can find all kinds of information on this platform that can help you to get a loan. Don’t worry! In this section, I am going to provide you with the steps that you can follow before you get any kind of loan. Read on…

Assess Your Financial Needs

First things first, you need to determine the type of loan that best fits your needs and preferences. This can help you understand the type of loan that you need, whether it is a mortgage loan, vehicle loan, or some other type.

Explore The Various Loan Options

You can explore the tracelones.com site to better understand the different loan types available and find out which is the best for you.

Application Process

Once you are done exploring the loan options, you can follow the guidelines on the website.

The website will help you understand which information you may need or what you must submit to your lenders.

However, you gotta be very careful in this process. In this application process, you need to write an accurate personal and financial application.

On top of that, the lender may ask you to provide documentation of identification, proof of income, and your credit history.

Make Sure To Review Your Loan Offers

Once you start to receive different loan offers from different loan lenders, you can proceed with comparing the terms and interest rates and rescheduling the payments.

So, you must try to be careful when choosing your loan options. Try to see if you have the returning capacity. Lastly, make sure that you are reviewing it thoroughly and reading whatever is written on the agreement.

Finalization

In this step, you will have to complete all the requirements that your lender might ask you. This can help to finalize your loan agreement process.

Now, one thing that you must remember is that you MUST have legitimate documents. Otherwise, you may face some serious trouble.

Distribution Of The Funds

Once your loan offer is accepted, the amount will be transferred to your bank account in the given time period.

Key Features And Services Of Traceloans.Com

In this section, I am going to talk about the key features and services that make Traceloans.com an eligible platform for you. Read on…

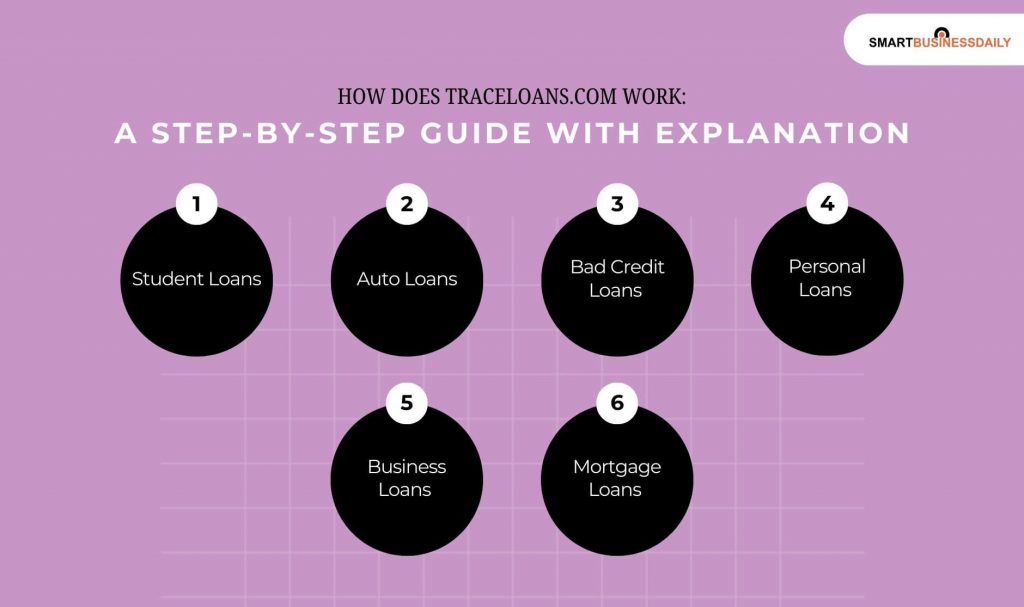

Loan Category Diversity

Traceloans.com has resources ready for all kinds of loans that customers usually need in their lives. These loan types are:

| Student Loans | These loan resources help those students and their families to understand how they can apply for a loan for higher education. The student loan is an absolute game changer for many students. |

| Auto Loans | Are you planning to buy your favorite car? Well, with tranceloans.com auto loans, you can easily find the auto loan that suits your needs. |

| Bad Credit Loans | People with bad to worse credit scores can apply for these loans. As for traceloans.com bad credit, they don’t only find you the ways to apply for a loan with a bad credit score. They even help you to improve your overall credit score. |

| Personal Loans | Facing financial issues? Personal loans are there for your rescue. With these loans, you can get quick access to funds. |

| Business Loans | These loans typically support the small business owners. If you are planning to start your small business, you might get better funding through this loan type. |

| Mortgage Loans | Mostly, homeowners apply for mortgage loans that are suitable as well as favorable for them. |

Educational Resources

If you are looking for in-depth reports, actionable insights, and guidance that you can put into practice, then this platform is the ultimate den for you!

User-Friendly Interface

Traceloans.com is doing a great job in creating the website layout. The site is very user-friendly. As a user, you can easily navigate through the site.

Moreover, everything is so perfectly categorized it would not be that difficult for you to get access to the information.

Benefits Of Traceloans.Com

Now, you might be thinking why I must choose Traceloans.com. Well, I can give you plenty of reasons why it is perfect for you! Read on…

Informations that are very easy to understand

With traceloans.com, everything seems a little easy to understand. You will find various resources that will guide you for different loan types. But that doesn’t stop there! The platform also suggests loans based on your loans.

What else do you need? Financial tips? The platform even has it ready for you! They even help you to understand how you can pay back the loan.

Better Time Management

Traceloans.com provides you with all the information you need in one place. They may also suggest that you find good lenders. As a result, you can easily save you time.

Inclusivity

Bad credit score? No worries! traceloans.com bad credit has suggestions for all types of people with high or low credit scores. This is really beneficial for the users.

Transparency

The platform does not hide or spread information. Each and every piece of information is accurate enough to begin with.

Flexibility

The platform guides you in choosing the loan amount you need and the terms that can strongly meet your circumstances.

Wrapping It Up!

Traceloans.com simplifies borrowing a loan. It provides you with easy information and various loan options. Whether you require a personal, car, or student loan, the website assists you in finding the best lenders quickly.

You can save time, compare various offers, and make an informed decision without hassle. Start your loan process with confidence at Traceloans.com!

YOU MAY ALSO LIKE

Comments Are Closed For This Article