A Breakdown to Claiming The R&D Tax Credit Toward Payroll

4 Mins Read

Published on: 18 February 2022

Last Updated on: 09 September 2024

toc impalement

The R&D Tax Credit (or the Research and Development Tax Credit) is one of the most beneficial tax credits that can be used by entrepreneurs and innovators.

According to the PATH (Protecting Americans from Tax Hikes) Act of 2015, expenditures made by taxpayers in the R&D field qualified for many special provisions under the Act.

The most notable provision was that the R&D credit for conducting research-related activities was changed from temporary to permanent. In addition to this, the PATH Act also allows taxpayers to claim a credit against payroll taxes. The following sections will provide a breakdown of the process of claiming the R&D Tax Credit against payroll.

What is R&D Tax Credit?

The R&D Tax Credit refers to a business credit that gives companies an opportunity to lessen their federal tax liability. It is based on the amount of eligible research and development expenditure made by a company in a year.

The legislation for R&D tax was first passed in 1981, and since then, it has benefited many businesses in reducing their tax liability. However, the introduction of the 2015 PATH Act brings forth a renewed focus on research and development activities. It allows even more businesses an opportunity to access the transformative credits.

Businesses from various industries can be eligible for this tax benefit and all they have to do is perform their daily activities related to research and development.

The R&D tax credits can be claimed by companies that are involved in the development, designing, and improvement of products, software, formulas, or processes. The objective of the Act initially was to increase the number of technical work opportunities in the United States.

Businesses were encouraged to increase their investments in innovation. With the new provisions, the R&D tax credit can be claimed by companies of all sizes. It is no longer restricted to only major companies with large research labs. To claim R&D tax credits, it is important to look into the list of activities that qualify for this benefit.

What activities qualify for the R&D tax credit?

It is a common misconception that the eligibility of R&D tax credit is restricted to the development of innovative products. Various operations and activities like software development, new manufacturing methods, and improvement of product/process quality also qualify for the R&D credit. It has been found that start-ups can also utilize R&D payroll tax credit for five years. In order to qualify for the R&D tax credit, a company should be involved in the following activities –

- Development and designing of new processes or products.

- Enhancing the existing processes or products.

- Making improvements to the existing software and prototypes.

Claiming R&D Tax Credit Against Payroll

The 2015 PATH Act made comprehensive changes to the way in which R&D tax credit was used. Before 2016, businesses could only claim the tax credit to counterbalance their income tax liability. The 1981 law was not entirely effective in reducing the tax burdens of small businesses and start-ups.

This is because many small businesses and start-ups accumulate non-operating losses (NOLs) during the stage of research and development. As a result, many businesses were not able to use the credits for many years. With the new provisions in the 2015 Act, small businesses were allowed to claim an R&D tax credit against the part of their FICA payroll tax liability that is concerned with Social Security.

The election of R&D payroll tax credit (or Section 41(h)) allows small businesses and start-ups to use a portion of their R&D credit to offset around USD 250,000 in payroll taxes. The election of Section 41(h) is especially helpful during the early years of business when they are not able to generate adequate taxable income. Thus, they were not able to gain benefits from a tax credit.

Election Time and Method

An eligible business can claim the R&D payroll tax credit by electing the same in Form 6765 (Section D). They would need to report the amount of tax credit on a federal tax return along with Form 6765 attached to it. After the business has made the election, it can offset is its payroll taxes on the quarterly filing dates.

Limitation on Tax Credit

An eligible small business can claim R&D payroll tax credit for five years maximum, with a yearly limitation of USD 250,000. It mostly depends on the amount of usable R&D credit a business has, besides its tax liability in payroll. If any amount is not utilized in the taxable year, it is subjected to a carry-forward period of 20 years and a carry-back period of 1 year.

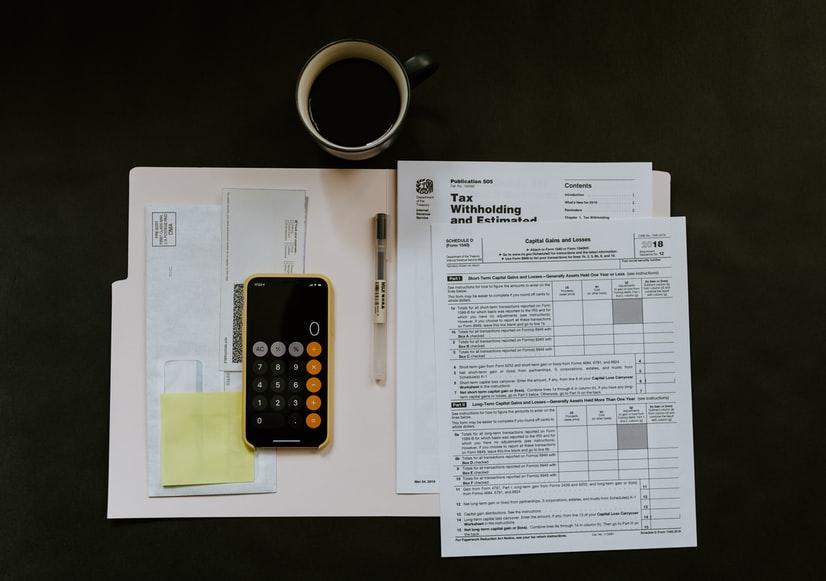

Documents for Reporting Payroll Tax Credit

- Form 6765: This is concerned with the tax credit for activities related to increasing research. It is used to make the election of payroll tax credit and it has to be attached with the income tax return of a business.

- Form 8974: This form determines the payroll tax credit amount that a business can claim on the Employer’s Quarterly Federal Tax Return (or Form 941). However, the quarter reported in Form 8974 should be the same as in Form 941.

Conclusion

Claiming R&D tax has become easier since the introduction of the 2015 PATH Act. Since the businesses can claim the tax credit for current as well as the previous tax years, it is important to document and evaluate the R&D activities. This is essential for authenticating the expenditure made for each research activity.

Read ALso:

Comments Are Closed For This Article