AMD Provides Soft Fourth-Quarter Guidance But Forecasts A $2 Billion Sell Of AI Chips Next Year

2 Mins Read

Published on: 01 November 2023

Last Updated on: 06 September 2024

toc impalement

Breaking!

AMD expects close to $6.1 billion in sales for the fourth quarter. But the analysts, on the other hand, were forecasting $6.37 billion in revenue.

AMD is one of the key players in the high-end GPU manufacturing business. These GPUs are capable of deploying generative AI models. Nvidia still dominates the market.

AMD is already on track with producing the MI300A and MI300X AI chips. They are ready for volume productions in the coming quarter.

Initially, the stock fell by 4% in extended trading, but recovery is visible as the company gave a high forecast for 2024 for its AI chip business.

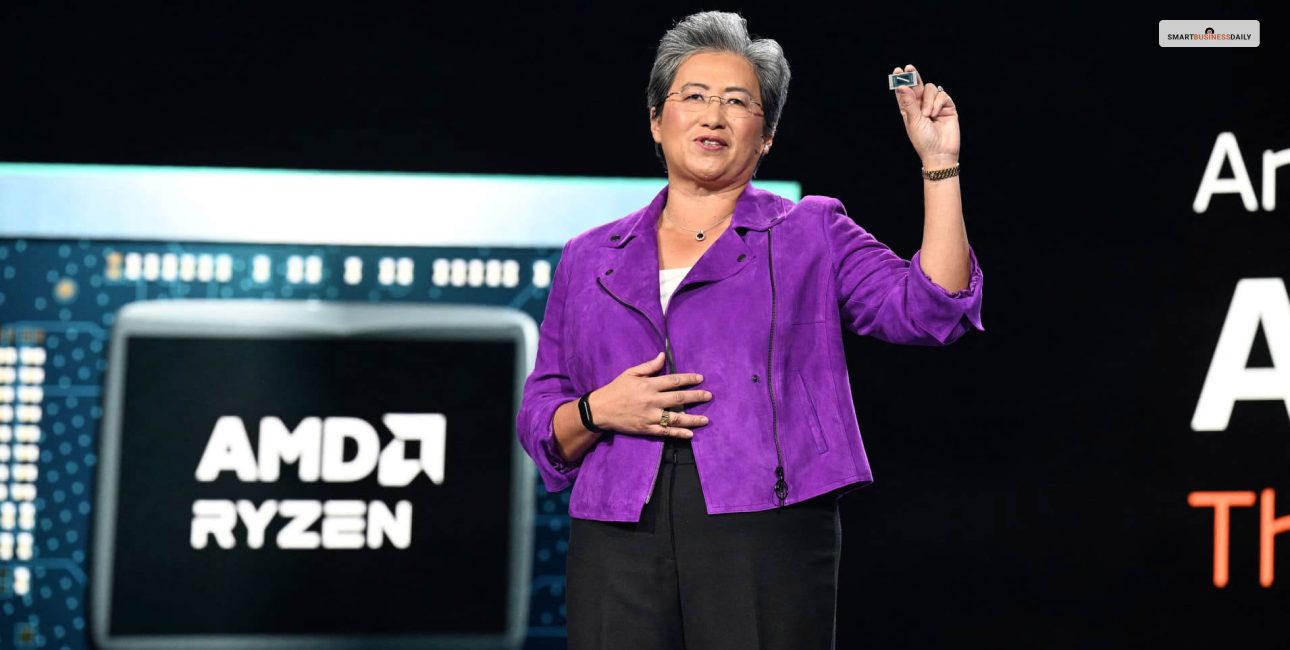

“We now expect data center GPU revenue to be approximately $400 million in the fourth quarter and exceed $2 billion in 2024 as revenue ramps throughout the year,” AMD CEO Lisa Su said during the earnings call.

Their net income has also increased to $299 million in the third quarter, or per share price has increased from $66 million pre-share only a few years ago. Their revenue was also boosted by $5.6 billion just a year earlier.

“We would like to be a significant player in this market,” Su said.

Su also mentioned their recent AI acquisitions and improvements in the AI software suite of the company.

“I think we all see the growth in generative AI workloads and the fact is we’re just at the very early innings of people truly adopting it for enterprise business productivity applications,” Su said.

AMD’s revenue from the Client group, including the sales from their PC processors, has increased 42% year over year to a number of $1.5 billion.

AMD’s rival, Intel, on the other hand, also reported its third-quarter earnings, beating its expectations for profit and sales. But they have still showed a year-over-year decline.

The embedded segment revenue of AMD was off 5% to 1.2 billion. The company, however, blames it on a pretty weak communication market. It includes parts for networking as well as the field programmable gate array of the company that it gained during its purchase of Xilinx.

However, their sales in the gaming segment did face a hit of 8% to $1.5 billion because of lesser “semi-custom” chip sales.

Read Also:

Comments Are Closed For This Article