Asset Sale Vs Stock Sale – Explanation Of Concepts And Key Differences

5 Mins Read

Published on: 01 October 2021

Last Updated on: 21 November 2024

toc impalement

The merger and acquisition market is becoming increasingly strong day by day. There are a number of opportunities prevailing in the market for business owners. Despite those, the biggest question that arises is “ asset sale vs stock sale ” which one is better?

There is no doubt that the concept of stock vs asset sale is relatively complex. Especially when it comes to making critical business decisions, the scenario becomes more challenging. This is the time when decision-makers need to take careful steps in terms of asset vs stock sale. Are you also looking for a perfect guide to asset vs stock sale?

What Is Asset Sale?

Before we directly jump into asset sale vs stock sale, let’s take a deeper look at what is an asset sale:

- Typically, asset sale happens when corporate firms or banks sell the receivables to other parties.

- From the buyers’ viewpoint, the best thing about asset sale is the buyer’s ‘ZERO’ liabilities. This is why buyers favor asset sales more.

- From a seller’s point, asset sales increase taxes as the hard assets are likely to have higher income tax rates.

- A number of benefits are associated with asset sales. For example, meeting liquidation requirements, resolving asset-related risks, and obtaining free cash flows.

- In the case of asset sales, an entity sells the whole or partial intangible and tangible assets.

- However, the key demerit of stock sales is that it is difficult to get credit while starting a new business.

What Is Stock Sale?

Asset sale vs stock sale – the debate is nothing new. Since time immemorial, business persons have been hovering above this debate. Now that you know what is asset sale, it’s time to gather insights on stock sales.

- Precisely, a stock sale is important when a business person buys shareholders selling stocks directly.

- Stock sales are unsuitable from buyers’ level as they may invite more unknown risks by purchasing company stocks. Some examples of these risks are environmental concerns, OSHA violations, future lawsuits, etc. Can you see the “ asset vs stocks sale consequences ” comparison here?

- From a seller’s level, stock sales are favored by most sellers owing to the lower capital gains. In addition, stock sales help the sellers get rid of liabilities from a non-tax outlook.

- Sellers of both S corporation and C corporation stock consider capital gains from the perspective of shareholders. So the “ S Corp Asset Sale Vs Stock Sale ” and “ C Corp Asset Sale Vs Stock Sale ” make sense.

- One of the most prominent disadvantages of stock sales is that sellers lose ownership to some extent. Although you are raising funds, some of your ownership goes into the hands of investors.

Asset Sale Vs Stock Sale – The Key Comparison

The pros and cons of asset vs stock sale are on trend today. It is both buyers and sellers whose equal benefits are associated with asset vs stock sale. I hope by now you have got a vision of “ asset vs stock sale ” from the above discussion. So, let’s jot down the bottom line of asset sale vs stock sale tax consequences.

| Deal | Asset Sales | Stock Sales |

| The outcome | With stock sales, you can stay away from a high corporate-level tax from the gains on sale. | Sellers choose Stock sales |

| Asset sale vs Stock sale tax consequences | On the contrary, with asset sales, buyers can save tax for the future on the basis of stepped-up tax. | Buyers choose Asset sales. |

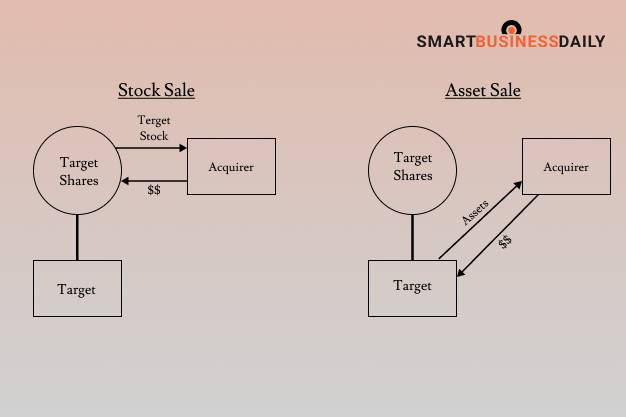

Diagramatic Presentation Of Asset Sale Vs Stock Sale Consequences

“C Corp Asset Sale Vs Stock Sale” And “S Corp Sale Vs Stock Sale”

We can shed some light on C Corp Asset Sale Vs Stock Sale and S Corp Sale Vs Stock Sale. If the assets are sold to a C corporation, the seller is vulnerable to double taxation. Alternatively, if the S corp assets are sold, the organization doesn’t have to pay any taxes, in spite of earning the sales in capital gains.

Hence, C Corp Asset Sale Vs Stock Sale And S Corp Sale Vs Stock Sale are something that every business owner should know.

What’s Better? Stock Sale Vs Asset Sale?

As you can see, both stock and asset sales are helpful for an organization to stay away from unnecessary tax burdens. It’s difficult to tell which one is effective from a single perspective. The answer is different from both seller and buyer’s perspectives. The gist is that Stock sales are for sellers while asset sales are for buyers. Nevertheless, these are broad generalizations and not really a thumb rule. Based on the tax environment, legal structure, corporate structure, etc., this may change.

Frequently Asked Questions

Q1. What Is A Stock Sale Vs Asset Sale Example?

A stock sale vs asset sale example is pretty simple. In a sale stock, the seller gives shares to the buyers. While in an asset sale, the seller gives assets to the buyers.

Q2. Which Is Better Asset Sale Vs. Stock Sale?To be very precise, sellers tend to prefer stock sales while buyers select asset sales. On the one hand, asset sales bear a lesser risk for buyers. It is because it is the seller’s responsibility to deal with debts, litigation, etc. Moreover, in stock sales, the proceeds are taxed at a reduced capital gains rate, while the C-corporations bypass corporate-level taxes. Q3. Are Stocks Considered An Asset?The funda of stocks is a little different. Stocks are not real assets; rather they are financial assets. Financial assets are basically paper assets that you can convert into cash. Furthermore, common stock is considered as equity, neither a stock nor an asset. These concepts are too vital in understanding the asset sale vs. stock sale consequences. Q4. Why Do Sellers Prefer Stock Sales?It’s true that sellers prefer stock sales. That is mainly due to considerably lower capital gain treatment. However, a buyer may also prefer sale stocks if the target company’s permits or contracts are favorable. It is not possible to assign them to a new owner but will keep sustaining through stock acquisition. |

The Final Words

To conclude, the asset sale vs stock sale debate does not have an ending. If you are a seller, the stock sale would be the better option for you. Whereas, if you are a buyer, then go for asset sales. As simple as that! However, the real-world business scenario is even more complicated, and you have to consider several associated factors while making decisions. So it may also happen that buyers are choosing sale stocks and vice versa.

Was this asset sale vs stock sales guide able to solve your confusion? Let us know your experience of reading this guide in the below section. We will be answering your asset sale versus stock sale queries soon. You can also check our similar article on Sale vs Sell.

Read Also:

Comments Are Closed For This Article