Cigna Drops The Pursuit Of Humana, Plans A $10 Billion Share Buyback

11 December 2023

2 Mins Read

toc impalement

Cigna, the U.S. health insurer, has opted to discontinue its pursuit of acquiring rival Humana due to an impasse in negotiations over the deal’s pricing, according to insiders familiar with the situation. The collapse of talks comes as Cigna concurrently announces plans to repurchase $10 billion worth of shares, reflecting the company’s strategic approach to capital deployment.

The proposed Cigna-Humana merger, with a combined market value surpassing $140 billion, was destined to face rigorous antitrust scrutiny, reminiscent of regulatory interventions that thwarted similar mega-deals six years ago in the U.S. health insurance sector.

Sources revealed that the breakdown in negotiations primarily stems from the inability of both parties to reach a consensus on the deal’s pricing. Despite this setback, insiders suggest that a potential collaboration between Cigna and Humana remains a possibility in the future.

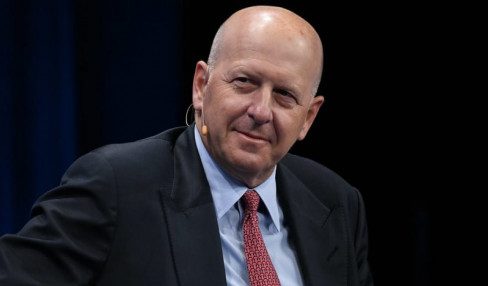

In response to the aborted acquisition, Cigna unveiled plans to undertake an additional $10 billion in share repurchases, elevating the total repurchase amount to $11.3 billion. Cigna’s Chairman and CEO, David Cordani, expressed the belief that the company’s shares are undervalued, emphasizing the value-enhancing deployment of capital to support high-quality care, improved affordability, and better health outcomes.

Moreover, Cordani stated that Cigna is open to exploring bolt-on acquisitions aligned with its strategic goals, along with “value-enhancing divestitures.” Notably, the company is actively considering the sale of its Medicare Advantage business, signifying a strategic shift in its previous expansion efforts in that sector.

While Humana declined to comment on the situation, Cigna refrained from responding to Reuters’ inquiries about the concluded deal talks, as initially reported by the Wall Street Journal.

The collapsed merger would have positioned the combined entity to rival major U.S. health insurance players such as UnitedHealth Group and CVS Health. Cigna and Humana, with market values of $77 billion and $59 billion, respectively, share business overlap, particularly in Medicare plans for older Americans.

Despite the current setback, Cigna’s exploration of selling its Medicare Advantage operations may address antitrust concerns, potentially enhancing the feasibility of a future merger with Humana. The healthcare sector has a history of antitrust challenges, with past court decisions leading to the abandonment of major deals.

Read Also:

Comments Are Closed For This Article