Difference Between Vat And Sales Tax – Best Comparisons

6 Mins Read

Published on: 07 October 2021

Last Updated on: 21 November 2024

toc impalement

Are you the one who doesn’t like to give VAT and Sales Tax to the government? Trust me; I also used to think the same till a few months back until I came to know their importance. You also must know the difference between VAT And Sales Tax and their effectiveness in a country’s economic development.

So, today, I have come up with this post on the difference between VAT and Sales Tax. Here not only we have explained sales tax vs VAT here, but also we have explained the VAT and Sales Tax in detail. So without any more ado, let’s begin.

What Is VAT?

I know you have heard about this term a number of times but do you know what it actually is? VAT or Value Added Tax is a consumption tax levied upon the consumers at each level of the supply and retail system. The funda behind collecting VAT is raising the government revenue. Opposite to the use tax or sales tax in the U.S., the government of a country determines the VAT. Thus the difference between VAT and sales tax makes more sense. With a flat tax rate across the country, it distinctively stands away from the progressive tax system.

Advantages Of VAT

Before we dive into the difference between VAT and sales tax, let’s take a look at the pros of VAT:

- It helps to raise funding revenue for the government

- Promotes transparency and reduces tax evasion

- Increases tax compliance

- VAT enhances the accounting system

Disadvantages Of VAT

Although VAT is completely meant for broader economic development, it is disadvantageous for certain reasons:

- VAT tax is regressive

- The calculation of value-added tax is quite complicated.

- VAT implementation is costly

- All sales records and purchases have to be maintained.

What Is Sales Tax?

Sales tax is another consumption tax the government imposes on the sales of services and goods. The aim of sales tax is pretty clear – generating government earnings so that they can support the state’s welfare activities. As the sales tax has some sharp distinctive features, the difference between VAT and Sales tax is easily interpretable.

Suppose you have purchased a smartphone that costs $400 and you have to pay a 7% extra amount along with it which equals $2. This extra amount is the sales tax that you will be imposed on the end customer, i.e., you.

Advantages Of Sales Tax

This VAT vs sales tax discussion will be clearer upon discussing the merits of Sales tax. The pros of sales tax are:

- It is a more simplified form of tax

- There is transparency because everybody pays the same rate

- Helps immensely in increasing government revenue

- Easy to collect

Disadvantages Of Sales Tax

Isn’t the difference between sales tax and VAT becoming more prominent? Well, we have also presented the cons of sales to make the value-added tax vs sales tax discussion more intriguing:

- The tax burden is high

- Regressive in nature

- Uneconomical at times

- Increases prices unnecessarily.

The Difference Between VAT And Sales Tax – Vat Tax Vs Sales Tax

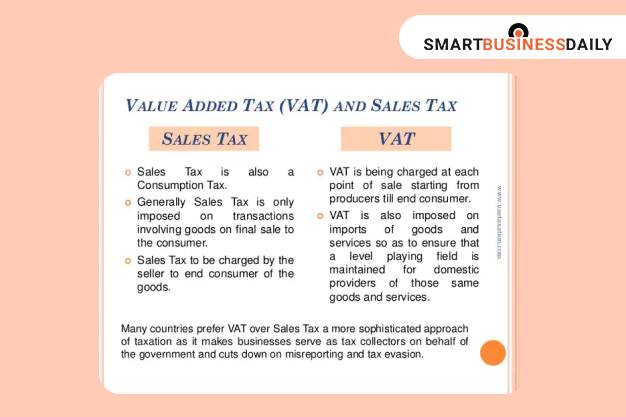

Now that we know what is VAT Tax and what is sales tax, it’s time to know the difference between VAT and sales tax. We have presented this difference between VAT and Sales Tax in a tabular format:

| Points Of Difference | Definition | Tax Evasion | Burden On | Imposed at |

| VAT Tax | VAT or value-added tax is the amount imposed at each level of a product’s life cycle. | VAT Evasion is not possible | VAT is rational | VAT is added to the product value at each stage of the supply and retail chain. |

| Sales Tax | The amount of tax charged at the final stage of the sale on a product’s total value is called Sales Tax. | Evading Sales Tax evasion is sometimes possible. | The sales tax burden falls on the final consumer directly. | Sales tax is levied on the final value of the service or product. |

Similarities Between VAT And Sales Tax

Enough of the difference between VAT and sales tax. Have you ever thought about the similarities between them? Let’s see where these two are identical to each other:

- Both VAT and sales tax are applied to selling goods. Sometimes the duo is also called VAT sales tax.

- VAT and Sales tax increases the prices of consumer services and goods

- Both of them are intended to generate government revenue

I hope the difference between VAT and Sales tax is now crystal clear to you. So, indirectly involved in the broader welfare of the state.

Frequently Asked Questions

Q1. What Is The Difference Between Vat Tax And Sales Tax?

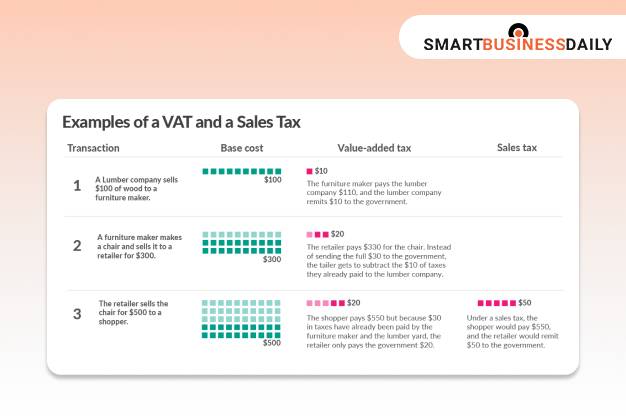

It is crucial for everybody to know the difference between VAT and sales tax. For example, the retailer collects the sales tax from the final customer. While sellers at each stage pay the VAT at successive stages of the supply chain.

Q2. Based On The Receipt, What Is The Sales Tax Rate In Sacramento, California?

Based on the receipt, 8.5% is the sales tax rate in Sacramento, California. However, the minimum combined sales tax rate in 2021 for Sacramento Country, California, is 7.75%. It is basically the tidal counties and sales tax rates.

Q3. Is VAT An Example Of Sales Tax?

VAT is actually very similar to sales tax, although there is a thin line of difference between them. The primary difference between the two is that VAT is accessible at each of the production or purchase processes. Every consecutive buyer pays VAT. Oppositely, Sales tax is assessed at the end stage of the purchasing process, and only the final customer pays it.

Q4. How Is An Excise Tax Different From A Sales Tax?

Excuse duty is much different from sales tax. Mainly, excise duty imposes on the production. On the other hand, sales tax is imposed on the sales of the goods, i.e., that sales price.

Q5. How To Avoid Sales Tax Online?

In order to avoid sales tax online, all you have to do:

- Shop from the resale places like Half.com or eBay.

- Be careful about the shipping address.

- Go for a company without any physical address in the state where you reside.

- Purchase from the websites having separate in-store and online businesses.

Q6. What Is A VAT Number In The US?

What is a VAT number in the US? VAT number is basically an important identification number for VAT-registered firms. However, as the US has no VAT system, there is no VAT number over there.

The Final Takeaway

Sales tax and VAT are the two most essential parts of the taxation framework in any country. Both of them are important for the economic growth of a nation. However, in low-income countries, VAT and Sales take a heavy toll on the people. Thus, it is necessary to understand the difference between VAT and Sales Tax.

What do you think about this post on the difference between VAT and Sales Tax? Do let us know your feedback in the comment area below; we will be responding to your queries. Also, if you have any other valuable insights on vast vs sales tax, don’t hesitate to let us know.

Read Also:

Comments Are Closed For This Article