Investing with a Conscience: A Guide to Ethical Investment Funds

20 January 2025

9 Mins Read

toc impalement

Ethical investment funds are gaining popularity as more individuals begin to invest according to personal values. The best ethical investment funds help investors support businesses with sustainable and ethical practices while achieving financial goals.

But what are ethical investment funds, and why should you invest in them? They focus on companies that show leadership in ESG: environmental, social, and governance—through which you can make a positive impact on society and the planet.

They also evade industries like tobacco, weaponry, or fossil fuels. This way, you will be assured that your money supports good practices. With ethical investing funds, you will grow your money and contribute to a better world.

In the next sections, we look at what makes these funds different, how they work, and their benefits. We will also discuss some challenges and share tips on choosing an ethical investment fund that best fits your needs.

The Concept Of Ethical Investment Funds

Ethical investment funds, or socially responsible funds, focus on investments that apply specific criteria to their chosen companies.

They exclude industries such as tobacco, weapons, or fossil fuels. Yes! They only invest in companies with sustainable and responsible practices.

This will, by and large, have returns for the fund investor and aims to generate constructive social or environmental change.

Ethical investment funds help to grow your wealth without compromising your principles. They combine financial goals with a sense of responsibility toward society and the environment.

Ethical Investment Funds: The Importance

Traditional investing often focuses solely on maximizing profits without considering the broader impact on people or the planet. Ethical investment funds challenge this approach by prioritizing sustainability and social responsibility. By choosing these funds, you play a part in fostering a more equitable and environmentally conscious future. Here’s why they matter:

- Promoting Positive Change: Investing in ethical funds invests your money into companies championing renewable energy, fair labor practices, and innovation. Companies leading the charge for a sustainable and inclusive world are at the forefront of this new paradigm.

- Avoiding Harmful Industries: Ethical funds avoid investment in industries known to cause harm to society and the environment, like coal mining, child labor, or arms manufacturing. This way, your investments will not support practices that are harmful to society or the environment.

- Align Investments with Values: Ethical funds allow you to invest in a way that reflects your personal beliefs and principles, making your financial journey more meaningful.

- Encouraging Corporate Responsibility: When ethical funds favor companies with responsible practices, they encourage others to do the same. The result is a positive change that ripples through entire industries.

Invest in ethical funds and secure financial growth and contribute to a brighter and more sustainable future.

The Types Of Ethical Investment Funds

Ethical investment funds come in different styles to suit different values and goals. Here are some common types:

1. ESG Funds: These funds focus on companies with strong ESG practices. For example, they may invest in firms that are reducing carbon emissions or increasing their diversity scores.

2. Socially Responsible Investment (SRI) Funds: SRI funds exclude companies involved in unethical practices like gambling, alcohol, or arms manufacturing.

3. Impact Investment Funds: These funds seek to generate measurable positive impacts in areas such as clean energy, affordable housing, or education.

4. Faith-Based Funds: These funds invest according to specific faith-based guidelines, catering to individuals with corresponding religious beliefs.

How Do Ethical Investment Funds Work?

Ethical investment funds work by researching and screening companies in advance. Thus, placing them in a portfolio reflects the actual set of investee companies that is aligned with specific ethical criteria. Most use two such principal methods.

◼ Negative Screening: Negative screening excludes companies that do not meet ethical standards. For example, funds avoid industries such as tobacco, guns, or oil that negatively affect society or the environment.

◼ Positive Screening: On the other hand Positive screening, focuses on selecting companies that make a tangible positive impact. Examples include businesses involved in renewable energy, sustainable agriculture, or community development.

On top of that, many ethical investment funds use ESG – Environmental, Social, and Governance – ratings to screen companies. These ratings quantify the commitment of a company to sustainability, social responsibility, and good governance practices.

Using these methods, ethical investment funds ensure your money is used for causes you believe in while aiming for financial growth.

Ethical Investment Funds: Advantages

Ethical investing comes with a lot of benefits, both financial and non-financial.

➡ Aligning with Values: Your investments reflect your commitment to a better world.

➡ Encouraging Sustainability: You support companies that are reducing waste, saving energy, or helping communities.

➡ Long-Term Growth: Ethical companies often focus on sustainable practices, which can lead to long-term success.

➡ Attracting Conscious Consumers: Ethical Firms tend to get better consumer loyalty, increasing their profitability.

➡ Mitigating Risks: Avoiding Controversial Industries Reduces the Risk of Scandals or Lawsuits.

Ethical Investment Funds: What Are the Challenges

While ethical investment funds have a lot of upsides, they also have downsides that are worth mentioning.

➡ Limited Options: Ethical funds often exclude high-profit industries such as fossil fuels or weapons manufacturing. This limits the range of investment choices.

➡ Potentially Lower Short-Term Returns: The focus on sustainable practices companies may bring slower returns compared to high-risk or traditional investments.

➡ Varying Definitions of “Ethical”: Each fund has its criteria for what qualifies as ethical. It’s important to research and ensure their values align with yours.

➡ Greenwashing Risks: Some funds may exaggerate their ethical claims while including companies with questionable practices. This practice, known as greenwashing, can mislead investors.

With such obstacles notwithstanding, the growing demand for sustainable financial solutions continues to drive improvements in ethical investment funds. Keeping abreast and being selective in your choices is a sure way to overcome such hurdles while doing good.

How To Choose Ethical Investment Funds

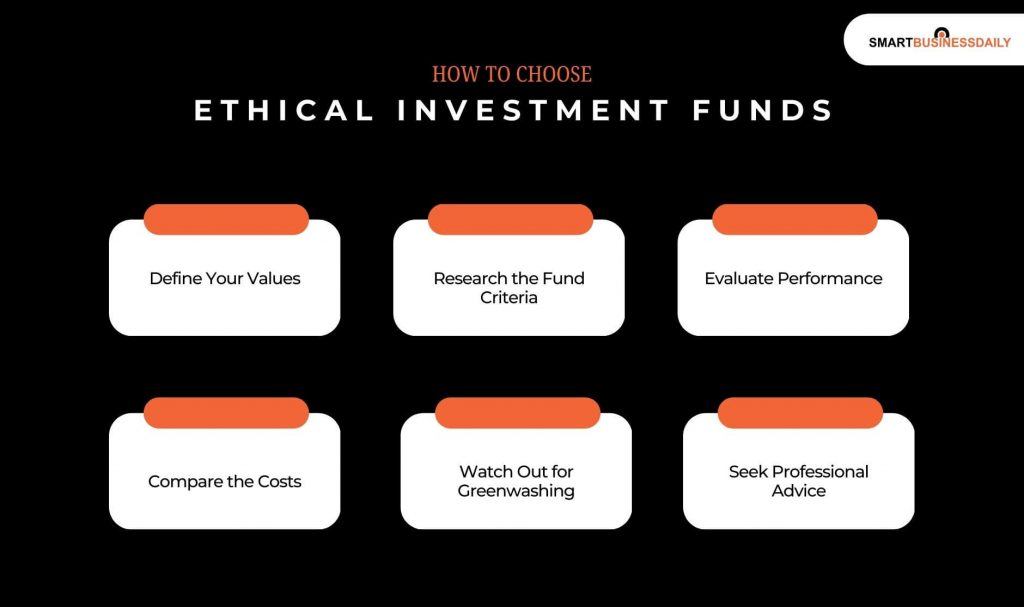

Ethical investing – choosing ethical investment funds can feel quite overwhelming, but it’s easier if you follow these steps:

◼ Define Your Values: Start by identifying what matters most to you. Are you passionate about environmental conservation, social justice, or ethical governance? Knowing this will help you find funds that align with your beliefs.

◼ Research the Fund Criteria: Not all ethical funds apply the same screening criteria. Find out what each fund’s screening process is. Do they focus on excluding harmful industries, promoting positive impact, or both? This is essential in understanding how they work.

◼ Evaluate Performance: Check the past performance of the fund. Ethical funds may be sustainable. However, it is equally important that they provide reasonable financial returns.

◼ Compare the Costs: Ethical funds can sometimes have higher management fees. Check if the performance and impact of the fund justifies costs.

◼ Watch Out for Greenwashing: Be wary of those funds that purport to be ethical but have companies with questionable practices within them. Double-check their portfolio for transparency.

◼ Seek Professional Advice: If you’re unsure, consult an independent financial adviser with ethical investing expertise. They should be able to guide you toward funds matching your values and financial goals.

By taking these steps, you’ll be well on your way to choosing ethical investment funds that grow your wealth and contribute to a better future for everyone.

Ethical investment Funds: Tools and Resources

Ethical investment funds allow you to grow your money while supporting causes that you care about, such as environmental sustainability and social justice. They invest in companies that operate according to specific ethical principles, which means your investments will reflect your values.

First, consider your personal values and financial goals. Research the various types of ethical funds available, such as ESG (Environmental, Social, and Governance) criteria-based funds, SRI (Socially Responsible Investing), or impact investing. Each has its own approach to promoting positive change.

Use resources such as financial advisers or websites specializing in ethical investment to guide you in selecting appropriate funds. Research tools and databases can help you understand a fund’s performance and its ethical footprint. Keeping up with industry reports and publications will keep you abreast of trends and new developments in the field of ethical investing.

You can create a better world and still meet your financial goals by making careful choices about which ethical funds to invest in.

The Cost Of Ethical Investment Funds

Ethical investing funds, better known as ESG (Environmental, Social, and Governance) funds, differ in cost depending on management style, type of fund, and specific strategy.

The expense ratio usually expresses these costs as an annual fee, a percentage of the average assets under management.

Expense Ratios:

- Actively Managed ESG Funds: These involve portfolio managers’s specific investment decisions to meet ESG objectives. They generally have higher expense ratios, often between 0.5% and upwards of 1%.

For example, the Azzad Ethical Fund (ADJEX), which focuses on mid-cap companies adhering to ethical investment restrictions, falls into this category.

- Passively Managed ESG Funds (ETFs): These funds track ESG indices and tend to have lower expense ratios, generally between 0.1% and 0.5%.

For instance, the Vanguard ESG U.S. Stock ETF (ESGV) has been noted for its low-cost focus on U.S. stocks with strong ESG practices.

Top Ethical Investment Funds: The Best 5

Ethical investing is all about putting your money into funds that best fit your values, whether supporting sustainable businesses, fighting climate change, or championing social justice. Here are five top ethical investment funds to consider:

| Vanguard FTSE Social Index Fund | This is known for investing in companies that are focused on environmental sustainability, social good, and corporate governance. It’s an excellent option for those who want broad exposure to ethical companies. |

| BlackRock Impact US Equity Fund | This fund is known for focusing on companies that promote social impact. It targets businesses with strong sustainability practices, human rights records, and more. |

| iShares MSCI ACWI Low Carbon Target ETF | If you’re passionate about the environment, this fund focuses on companies reducing their carbon emissions. It’s perfect for eco-conscious investors. |

| PAX Elevate Global Women’s Leadership Fund | Invest in companies with more women in leadership positions to further the cause of workplace gender equality. |

| Fidelity U.S. Sustainability Index Fund | A good option for U.S.-focused investors, it invests in companies committed to sustainability, the environment, and good governance practices. |

These funds enable you to make a positive impact while growing your money. It’s all about selecting a fund that aligns with your personal values!

The Future of Ethical Investing

Ethical investing means putting your money where your values are, and it’s taking off like never before. These funds invest in companies that come under environmental care, social responsibility, and good governance, most commonly referred to as ESG factors. The future of ethical investing looks promising as more people want their investments to reflect their beliefs.

With growing awareness of climate change, diversity, and fair business practices, ethical funds are becoming mainstream.

Technology and better data analysis make it easier to evaluate a company’s impact, ensuring investors can align with causes they care about. Plus, younger generations, who are particularly value-driven, are driving demand for socially conscious investment options.

While returns may have been a concern in the past, studies generally indicate that ethical funds often perform as well as, or better than, their traditional counterparts. So, the future of investing isn’t just about profit; it’s about purpose.

Wrapping It Up!

Ethical investment funds are a great way to align your financial goals with your values. They allow you to grow wealth while supporting causes that mean something to you. Avoiding harmful industries and promoting sustainability means these funds contribute to a better world.

However, it is essential to research and understand the criteria of each fund. Look for funds that best match your priorities. Try to offer a balance between ethical practices and financial returns.

With careful planning, ethical investment funds can help you make a meaningful difference while securing your future.

Ready to make your money matter? Start exploring ethical investment funds today. It’s an investment in your future and the well-being of the planet.

YOU MAY ALSO LIKE:

Comments Are Closed For This Article