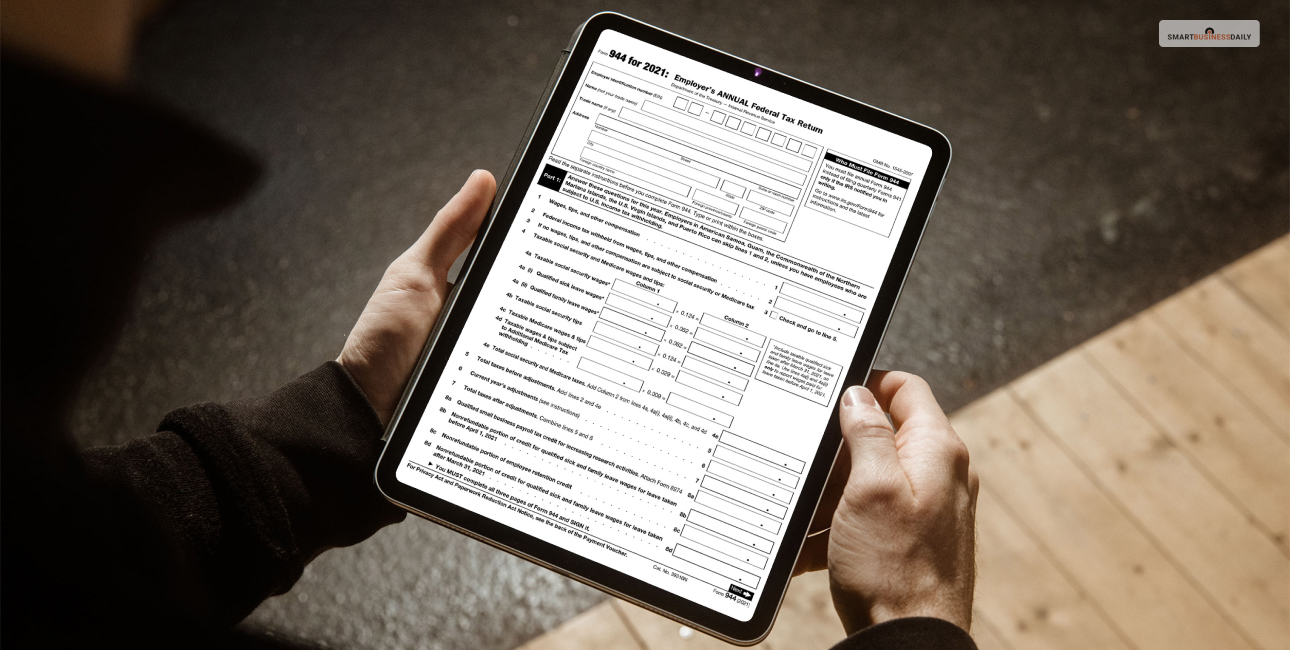

Form 944, Employer’s Annual Federal Tax Return – Let’s Understand

5 Mins Read

Published on: 18 August 2023

Last Updated on: 29 February 2024

If a small business has active employees, then the business’s tax obligations include reporting the payroll and income taxes. It is what the business withholds from the employees. This is what brings us to our topic – form 944.

This information is typically reported using the Form 941, which is also known as the Employer’s Quarterly Federal Tax Return.

However, for small businesses with lesser tax liabilities it is different. They might have to file a different IRS form which is known as Form 944.

In this article, I will take you through all the details of the IRS Form 944. We’ll also discuss which businesses are eligible to use it. Additionally, to all the instructions that are needed to correctly file the form.

What Is The IRS Form 944?

IRS Form 944 is a tax return document. It reports taxes including Medicare tax, (FIT) Federal Income Tax, and social security tax. Employers withhold these taxes from employee paychecks.

Form 944 is also used to evaluate and report the social security tax and Medicare tax liability of the employer.

The IRS Form 944 was particularly created for small businesses that have less employees and, therefore, fewer tax liabilities.

The Form 941 is almost the same form which reports the exact same information. However, it is required to be filled quarterly, but Form 944 only requires an annual filing.

Businesses having an employment tax liability of $1,000 or less are eligible to file the IRS Form 944.

Therefore businesses that are eligible to file the IRS Form 944 instead of Form 941 will only have to file their tax returns once a year and not quarterly, unlike other big businesses.

Who Is Required To File Form 944?

Most businesses are required to file Form 941 quarterly to accomplish the necessary IRS requirements. These are necessary for evaluating and reporting employment taxes.

With that being said, selective businesses are only required to file IRS Form 944 annually.

But, this is only eligible for businesses that expect their employment tax liabilities to be $1,000 or less for the financial year.

However, filing Form 944 instead of Form 941 may require written approval of the businesses’ eligibility directly from the IRS. The IRS is supposed to notify if the business is eligible or needs to file Form 944.

If a business is required to file Form 944, they are entitled to file the same and may not file Form 941 unless it has requested and received permission from the IRS.

Similarly, if a business is only eligible and not required to file Form 944, they may still continue to file Form 941 quarterly if they so choose.

Additionally, if the business has not received an IRS notification about its eligibility to file Form 944 but they are sure that they meet the tax liability requirements, they may contact the IRS via phone or mail to get the required changes done.

It must be, however, noted that this request is to be made within the initial months of the year. If the IRS considers changing the file requirements, they will notify you once again with a written notice.

Exceptions

However, there is a scenario where the business is not eligible to file either of the forms, and that consists of two major reasons, namely –

- If the business only hires household employees.

- If the business only employs agricultural employees.

Furthermore, if the business is new, they may request eligibility to complete Form 944. While completing form SS-4, which is the application for the employer application number, businesses may specify that they might meet the requirements to file Form 944.

Once the EIN is issued, the IRS will inform the businesses which of the two tax filing categories they are eligible for.

Where And How To File Form 944?

If a business receives a notification from the IRS that they need to file Form 944, they may question where to find it and how to file it. Additionally, they are bound to question when to file it, as Form 944 differs greatly from Form 941.

Just like any other IRS tax form, Form 944 is also available on the official website of the IRS.

There are a couple of ways in which businesses can complete and file Form 944.

You may print out the form and fill it out manually and mail it, or you can fill it out online and then get it printed to mail it.

There is information specified in the form itself related to the location where the form is supposed to be filed, which will differ based on the state from where the business operates and if the businesses are filing with a payment.

The IRS Form 944 may also be filed electronically, which is something that the IRS encourages businesses to do. To file the form electronically, the easiest way is to use the IRS E-file system, that will provide businesses with two alternatives.

Either businesses can file the return themselves by utilizing a software provider that is approved by the IRS, or they can take help from a tax professional who is approved by the IRS and can get the work done on behalf of the business.

However, if the business is already using an accounting or payroll service, the provider, in that case, has the functionality for the business to complete Form 944 and file it via their system.

Deadline For IRS Form 944

The deadline to file Form 944 varies compared to Form 941. While Form 941 needs a quarterly filing, Form 944 needs to be filed annually.

Therefore, the deadline to file Form 944 is January 31st for the former tax year.

However, if the business has successfully paid all the deposits in full and on time, they get a few extra weeks of time from the said deadline to file.

The exact extension date may vary from one year to the other, but it generally falls around February 11th.

The Bottom Line

IRS Form 944 and Form 941 are almost quite the same; however, the line of difference exists within their deadlines and eligibility crisis.

While Form 941 is made for big businesses, the smaller ones are eligible for Form 944.

Businesses are required to file Form 941 quarterly; however, Form 944 requires only annual filing.

A business that fails to submit either of the forms within the said deadline will be obligated to legal penalties.

These were all the insights that I had to provide in this article. I am hoping this has answered your questions. However, if there is anything else that you need to add, feel free to drop a comment below!

Read Also:

Comments Are Closed For This Article