Huawei’s Chipmaker Gives Warning About Global Tensions Creating Chip Glut

2 Mins Read

Published on: 11 November 2023

Last Updated on: 05 September 2024

toc impalement

This article presents a contrasting viewpoint to the more positive and optimistic statements made by Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co. regarding the anticipated recovery in mobile demand.

China’s largest semiconductor manufacturer, SMIC, recently shared a report of its third consecutive decline in quarterly revenue, highlighting the intensity of the industry downturn and the broader efforts by Washington to moderate China’s tech sector. This outcome disappointed investors who were hopeful that the unexpected fame of Huawei Technologies Co.’s new smartphones would assist in offsetting the loss in sales.

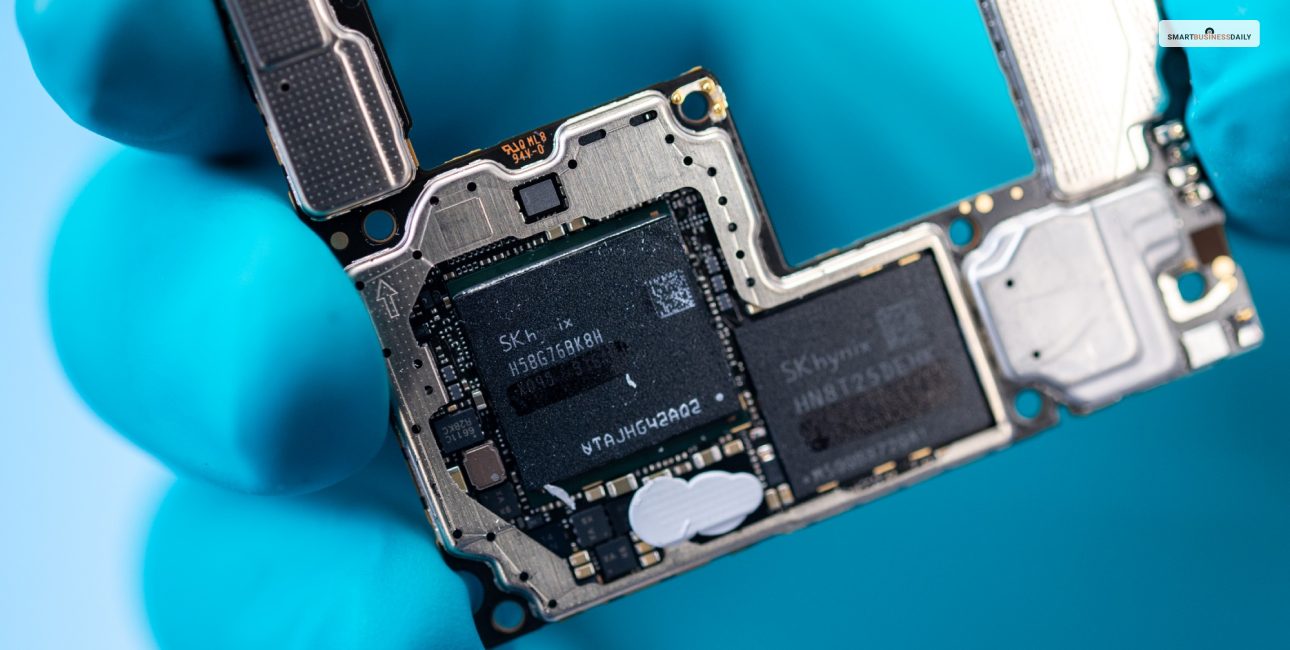

SMIC is a major player in China’s ambitions to set up a world-class technology sector that is more independent and does not rely on American innovations. The company played a crucial role in assisting Huawei in developing the 7-nm processor for its Mate 60 Pro, a device that earned rapid success, challenging Apple Inc.’s iPhone.

During the post-results briefing, analysts didn’t mention Huawei, but SMIC executives discussed how political tensions have prompted various countries, including the US, China, Japan, and Europe, to offer incentives to attract domestic chip manufacturing.

“From a global perspective, capacity will be excessive. It will take a lot of time to digest the new capacities built in recent years,” according to SMIC’s co-CEO, Zhao Haijun.

Despite a larger-than-expected 15% drop in revenue to $1.62 billion for the September quarter, SMIC’s shares had previously risen approximately 40% after the successful launch of the Mate 60 Pro by Huawei.

While State-backed SMIC is anticipated to return to growth in the December quarter, its future depends on whether the US, which recently expanded restrictions on China’s chip sector, contemplates additional sanctions in the future.

In the meantime, SMIC continues to face uncertainty in China’s smartphone market, which is the world’s largest, and is dealing with increasing competition from various players like Xiaomi Corp. and Oppo.

The smartphone industry is grappling with challenges, including a 5% decline in smartphone shipments in the third quarter, and none of the top five manufacturers sold more phones than in the previous year. Major Chinese smartphone manufacturers depend on chips from Qualcomm Inc. and MediaTek Inc., which also redistribute manufacturing to contractors overseas.

“The current smartphone replacement cycle wasn’t because of new innovations,” Zhao told analysts. “The overall smartphone shipment for next year should be on par with this year.”

The long-term outlook for SMIC and chip-related firms will depend on the level of support they receive from Beijing as China strives for semiconductor self-sufficiency. SMIC is increasing its capital expenditure for the entire year to $7.5 billion, indicating its capacity expansion efforts.

In summary, SMIC faces challenges and uncertainties in a competitive and dynamic semiconductor and smartphone market, with its fortunes closely tied to global geopolitical developments and Beijing’s support for the tech sector.

Read Also:

Comments Are Closed For This Article