Payday Loans eLoanWarehouse: Debt Or A Trap?

7 Mins Read

Published on: 30 October 2024

Last Updated on: 23 April 2025

- What Is A Payday Loan?

- Purpose of Payday Loans

- Understanding Payday Loans By eLoanWarehouse

- Eligibility of Payday Loans By eLoanWarehouse

- The Application Process of Payday Loans eLoanWarehouse

- How Does It Work?

- Advantages & Disadvantages of Payday Loans By eLoanWarehouse

- Pro- Cash Access

- Con- High Interest Rates

- Pro- Online Application

- Con- Shorter Tenure

- Pro- No Credit Check

- Con- High Debt-Cycle Risk

- Eloanwarehouse Vs. Reputable Lenders: The Comparison

- The End

Taking out loans is probably one of the easiest things you can do in today’s economy.

Countless organizations have developed their own schemes and loan programs. As a result, an increasing number of people are using them for personal purposes.

One such program is payday loans. Payday loans are typically short-term loans with high interest rates.

They are called payday loans because the amount is equivalent to your next paycheck.

Payday Loans are one of the most prominent ways to get fast and easy cash without hassle.

However, this does not mean you must pay no hidden prices. This article will examine some of the most significant and concerning factors you need to be aware of.

What Is A Payday Loan?

Payday loans typically range from $100 to $ 1,000. Therefore, you can avail yourself of this loan according to your needs and requirements.

As a result, this adds to their sense of convenience, which most other loans lack with their fixed lending cap.

These loans are perfect for getting quick cash. However, these loans come with very high interest rates.

As a result, it is often categorized as a form of predatory lending where lenders charge very high interest rates and run the risk of initiating a vicious debt cycle.

Then again, why are these loans so popular among the working class? Let’s stay and find out.

Purpose of Payday Loans

Payday loans are typically short-term and carry high interest rates. These loans are a great source of quick cash in your hands. However, the high interest rate is the caveat.

These loans are primarily taken out in emergency situations that compel individuals to borrow money. As a result, banks and organizations have kept this form of lending easy and quick.

Moreover, payday loans are often provided even to individuals with a poor credit score. Therefore, this is one of the reasons that banks provide for charging high interest rates.

These loans are ideal for unexpected expenses. Otherwise, there is no point in paying heavy interest rates on loans.

Understanding Payday Loans By eLoanWarehouse

Several different companies offer payday loans. However, today, we will focus on Payday loans by eLoanWarehouse.

eLoanWarehouse is a private lending company that has gained prominence recently.

It is one of the most prominent names in the private lending landscape of the United States. eLoanWarehouse has been actively trying to bring lenders and borrowers together.

Moreover, the company claims that it aims to simplify the loan application process, enabling more people to access quick and easy cash. The best part about the company is that its overall design beautifully replicates that of the platform.

Other than that, Payday Loans eLoanWarehouse works just as other payday loans. You can withdraw easy cash, but you may pay high interest rates.

Eligibility of Payday Loans By eLoanWarehouse

Like any other lending organization, eLoan Warehouse has defined and absolute eligibility criteria that every lender needs to fulfill. Otherwise, they will not be given loans.

This is likely because the company offers payday loans to individuals with bad credit and without requiring documentation.

Therefore, if you fall under this category, then you need to have a clear idea about the eligibility criteria for Payday loan eLoanWarehouse:

- Age Requirement: The borrower must be legally 18 years old and not younger.

- Income Verification: The borrower must present credible documents stating their steady income source.

- Bank Account: The applicant must hold a valid bank account. This account becomes important for loan disbursement.

- Residency: The applicant must have a permanent residency in the United States of America.

Here are some key considerations for both applicants and borrowers to keep in mind when considering a payday loan.

You may have a poor credit history. Still, you must present these documents to proceed to the next stage.

The Application Process of Payday Loans eLoanWarehouse

Getting your loan disbursed is not just about being eligible. It is also about the correct application process. Without the proper application process, you risk getting your application rejected.

Therefore, the next step is to complete the application process correctly. Knowing the correct way to apply for a loan is important. This section is all about that.

Here is the correct means of applying for payday loans from eLoanWarehouse:

- Visit the Website: Once you have assessed your eligibility, you can start the application process. To complete this process, please visit the website and submit the application form.

- Necessary Details: Please fill in all the details requested, including your name, address, and residence. Be very precise about these details.

- Submit the Form: Once you have filled out the form, you can begin the submission process. Please ensure that you submit the form in a ‘submit for review’ format.

- Please wait: Once you submit the form, you will need to wait for approval. This approval might take some time.

However, in most cases, the money and the approval come in under 10 minutes. The dispensing time depends on the server and other factors.

This is the comprehensive application process for payday loans at eLoanWarehouse. However, you must remember that banks and lending organizations typically update their loan application processes. Therefore, keep an eye out for any updates.

How Does It Work?

If you are considering taking out a payday loan from eLoan Warehouse, it is essential to understand how it works. This may not alter your approach to the entire matter.

However, knowing how things work when money is involved is always important. Therefore, here is a small rundown of how a payday loan by eLoanWarehouse works:

- The first part of the process is the application process. This is where borrowers provide the necessary details, including bank statements and address proof.

- The second part of the process is called the approval stage. This stage involves awaiting approval after the application stage.

- The third stage is called the disbursement stage. At this stage, applicants or borrowers receive their money. This could take one business day or a matter of minutes.

- The final step of the whole process is the repayment stage. In this stage, the bank expects the borrower to clear the debt.

This is how Payday Loans eLoanWarehouse works. Therefore, you must go through this process to clear the debt. ouse works. Therefore, you must go through this process to clear the debt.

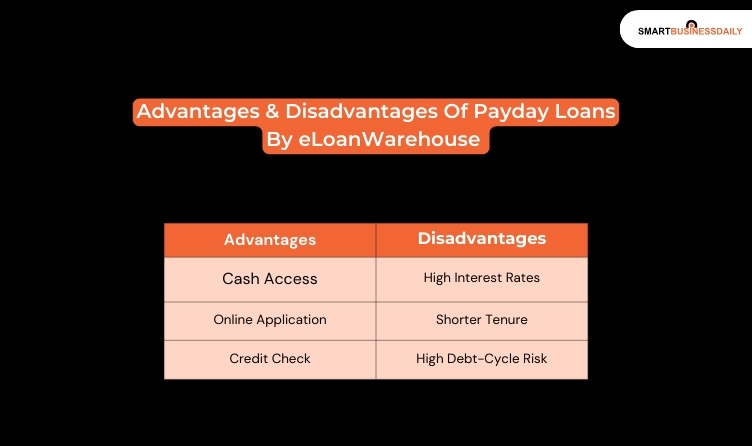

Advantages & Disadvantages of Payday Loans By eLoanWarehouse

Borrowers often overlook the fact that the loan process is complete once the money is disbursed. In actuality, this is not the case.

A loan is a huge responsibility. Therefore, it is crucial to have a clear understanding of the advantages and disadvantages.

In this section, we will be looking at some of the advantages and disadvantages you need to remember if you plan to avail yourself of Payday Loans eLoanWarehouse.

Here they are:

Pro- Cash Access

Payday loans typically operate in a fast cash disbursement format. This means that applicants or borrowers can receive the money within one business day. Therefore, they are perfect for emergency cash situations.

Con- High Interest Rates

These Payday Loans eLoanWarehouse are great for emergencies due to their fast cash disbursal. However, they come with a high interest rate. As a result, paying them off can become quite a hassle, which can pose huge difficulties in the long run.

Pro- Online Application

Applying for these loans is quite hassle-free. You can easily apply for these loans from anywhere. Most of these loan applications are done via the Internet. Therefore, they are easy to apply and hassle-free to a great extent.

Con- Shorter Tenure

These Payday Loans eLoanWarehouse are typically structured with a short repayment term.

This means the lending organization would give you a tenure of one to two months to pay off the loan.

This can be a significant challenge for someone who took out the loan for a medical emergency. Then, it would be difficult if they were already taking up medical expenses.

Pro- No Credit Check

In most cases, people gravitate toward payday loans eLoanWarehouse, when they have a bad credit score or an instant need for money.

Therefore, institutions usually do not undergo extensive background checks or credit checks. This makes the loan more accessible.

Con- High Debt-Cycle Risk

These loans come with high interest rates and short tenures. This is the most dangerous combination for people to fall into the debt cycle.

This can prove hazardous for individuals, as it may lead to bankruptcy or financial ruin. Both of which can be horrible and devastating.

Eloanwarehouse Vs. Reputable Lenders: The Comparison

In the following table, I am going to discuss how different eloanwarehouse is compared to the reputable lenders such as Earnin! Read on…

| Feature | Eloanwarehouse | Earnin |

|---|---|---|

| Interest Rates | 400% – 700% APR | 0% – Low optional tips |

| Hidden Fees | There are a lot of hidden charges and fees. | There are no hidden fees. The platform keeps everything transparent |

| Approval process | The process is very fast. However, it can easily affect the borrowers. | This is flexible. It is totally based on the borrower’s needs. |

| Repayment Terms | Rigid | Flexible. This is based on the borrower’s paycheck. |

| Customer Support | Very poor | The platform provides pretty supportive customer support. |

| Overall Cost | It might come as an excessive one. | The fair design can positively prevent traps. |

| Reputation | Untrustworthy | The customers have shared positive reviews. Moreover, it has a strong reputation. |

The End

In summary, payday loans can be a valuable financial aid. However, there are some notable caveats that you should be aware of. Otherwise, momentary help can turn into a lifelong problem.

Therefore, keep an open mind and weigh all your options carefully before making a decision.

Otherwise, things can turn out really problematic in the long run. Follow us for more such content on wealth and business management.

Comments Are Closed For This Article