QuickBooks Payroll Software – Find Out The Review And Benefits

05 July 2023

5 Mins Read

toc impalement

- Quickbooks payroll service offers automated and unlimited payroll processing.

- Small businesses with less than 150 employees will benefit from this payroll processing platform.

- The platform supports most of the common payroll processing features and is available in 50 states in the U.S.

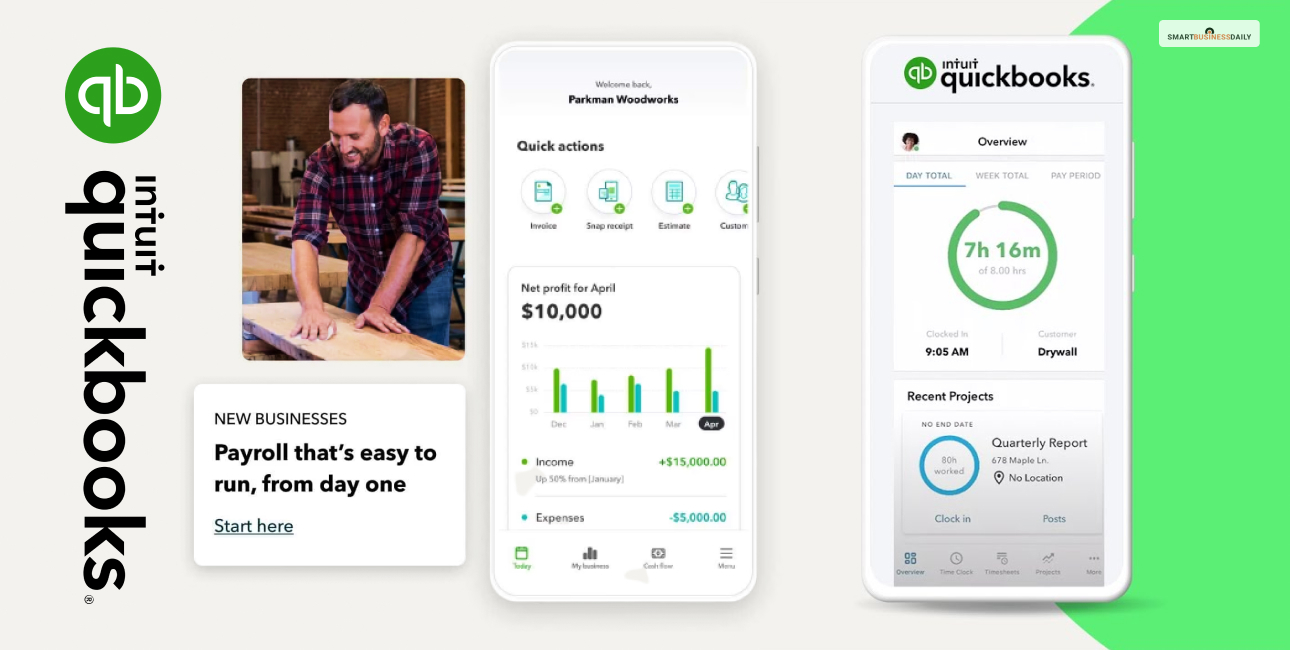

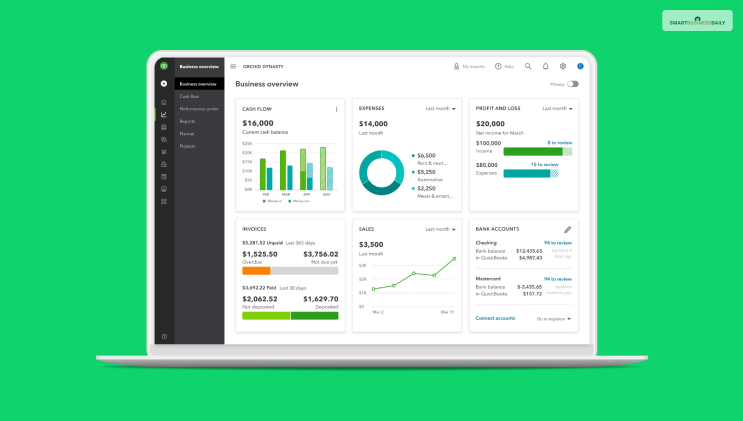

Quickbooks Payroll service operates as a stand-alone platform or works in integration. Users can use QuickBooks Payroll for payroll processing, tax filing, compliance, employee time tracking, benefits administration, and more.

The robust reporting features and the availability of this cloud-based payroll service in 50 states might seem intriguing to the users. However, users might not want to switch to the top-tier plan for a basic feature like employee time tracking.

If you have a small organization and need payroll processing services, you can consider Quickbooks. However, if you want to stay informed before purchasing a plan, go through this review I have put together.

What Is QuickBooks Payroll?

Quickbooks payroll service can be a good addition to the farms that are already using the Quiickgooks accounting software. This payroll service can work integrated with the Quickbooks Accounting software or work independently.

The platform is optimized to be used in 50 states in the U.S. Also, small to medium-sized businesses with less than 150 employees can use the Quickbooks payroll processing platform. According to many users, Quickbooks is one of the best payroll services.

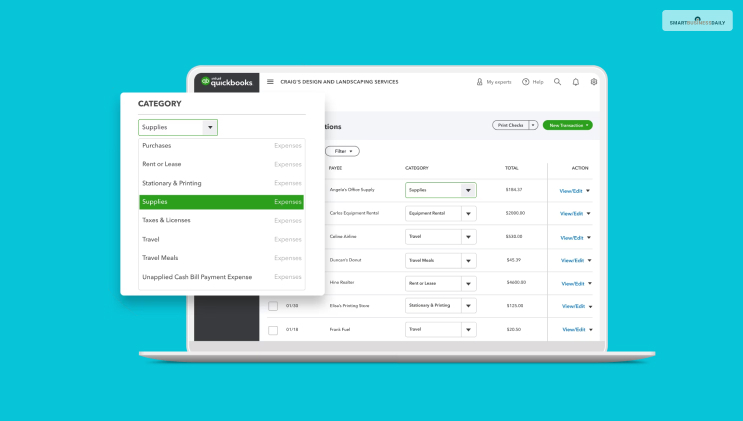

The platform includes common payroll service features such as tax filing and payroll processing automation, benefits administration, etc. Tax filing, calculation, and payment are available for federal and state taxes. But filing local taxes will require some manual work on the user’s part.

Is QuickBooks Payroll Right For Your Business?

Of course, the decision remains with you. But I can specify some benefits that small and medium-sized businesses can have with Quickbooks Payroll. First, it automates payroll processing for your business. Employers can enter all the details of employees and set up rules for calculating payroll for them.

Now, if your business has less than 50 employees and you need basic payroll tax filing and on-demand payment for the employees, then this is a good payroll processing platform to consider. You can run payroll for employees and contractors on the QuickBooks platform.

Also, users can take advantage of a wide selection of integrations (more than 253 third-party integrations supported.

The automated features and integrations help you create a perfect business ecosystem. However, the pricing plans can be a little expensive for small businesses. If you plan to cut down on budget, you will find other better-suited options for your organization.

Features Of QuickBooks Payroll

Quickbooks already has a good reputation as a tax filing and calculation software. QuickBooks has already made a name while competing with other popular payroll services like Gusto, OnPay, and Paychex Flex. Here are some of the features available through the QuickBooks Payroll service.

✔ Tax Compliance

QuickBooks payroll service stays compliant with tax regulations. It also allows users to track employee times, run payroll, and fill and submit different tax forms. The platform boasts an intuitive interface allowing users to access information about their payroll compliance, Social Security, applicable labor laws, workers’ compensation management, exemptions, health benefits administration, etc.

✔ Employee Onboarding

The employee onboarding process using the Quickbooks platform is also easy. Employers can easily create accounts for new employees on the Quickbooks platform and run their payroll. The employers can onboard new employees just by adding their names and email address. They can also let the employees fill out their personal information like tax and banking info by keeping the self-setup option on for them.

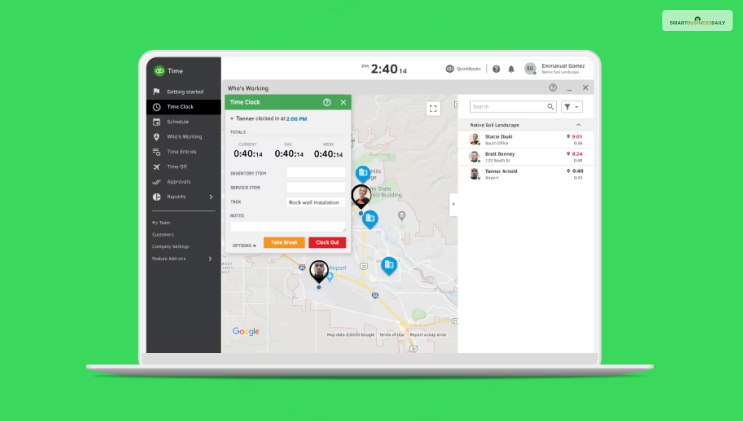

✔ Time Tracking

Users might not be happy to know that time tracking options come as an add-on feature on Quickbooks payroll services. Users have to switch to Quickbooks Premium, and Elite plans if they want to use employee time tracking.

However, it is needless to say how important employee time tracking is for employers. It is necessary for payroll processing and tax filing. With the use of Premium or Elite plans, employers can track the clock-in and clock-out times of the employees.

✔ Benefits Administration

Users of QuickBooks payroll processing service, users can cater to different employee benefits to their employees. For example, they can offer worker’s compensation through A.P. Intego. Also, Quickbooks offers affordable medical, vision, dental, and insurance packages through SimplyInsured.

✔ Accessibility

QuickBooks offers accessibility for users through mobile phones. Users can access the platform using their iOS or Android devices.

QuickBooks Pros & Cons

Here are some of the pros and cons of the Quickbooks payroll processing platform –

Pros

- Quickbooks allows users to run unlimited payrolls.

- The platform allows users to automate the calculation, filing, and payment of both federal and state taxes.

- The platform is accessible in all 50 states in the U.S.

- Robust reporting features.

- Manage garnishment.

Cons

- It is comparatively more expensive than its competitors.

- Time tracking and tax filing features are exclusive to top-tier plans alone.

QuickBooks Payroll Pricing: How Much Does Quickbooks Payroll Cost?

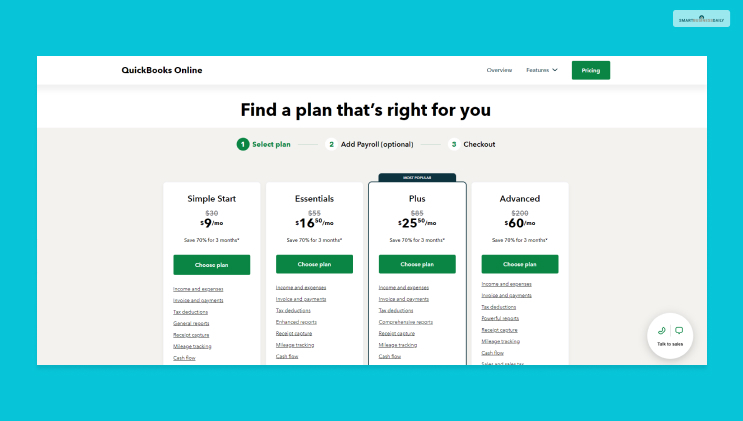

There are Start, Essential, and Plus membership plans on Quickbooks payroll service. Here is a breakdown of the Quickbooks payroll Fees –

Core + QuickBooks Simple Start: Costs $45/ month and $5/employee/month.

Core + QuickBooks Essentials: Costs $75/ month and $8/employee/ month.

Premium + QuickBooks Plus: Costs $125/month and $10/employee/month.

Quickbooks offers a 30 days trial for the users. If you want to use this payroll service, you can decide after using the free trial version for a month. Then, if it suits your needs and if the pricing plans are perfect for your budget, you can use QuickBooks Payroll.

Bottom Line

There are so many payroll processing software out there. You can choose the right one based on the nature of your employment and the size of your company. Small and medium-sized businesses can use QuickBooks Payroll.

However, there are lower-priced payroll service providers out there, and they also offer the same services for more affordable prices. If you are interested in features like on-demand payment, then Quickbooks might be a worth considering option. Otherwise, it is a little overpriced for smaller-sized businesses. Did you find this review helpful? Please let us know your thoughts on this topic.

Additional Resources:

Comments Are Closed For This Article