Avoiding Common Mistakes When Shopping For A Car Loan

5 Mins Read

Published on: 28 November 2023

Last Updated on: 24 January 2025

toc impalement

Securing a car loan is an integral step in purchasing a vehicle, yet it’s often navigated with a bit of caution. In their excitement to acquire a new vehicle, many car buyers overlook key aspects of auto financing, leading to costly long-term consequences. To ensure a financially sound purchase, it’s imperative to be aware of and avoid common mistakes.

This guide delves into frequent missteps in the car loan process, offering essential advice to navigate it effectively.

Ignoring Credit Health

Getting a car loan for the first time takes a lot of understanding and clarity. Therefore, some of the biggest markers of ignotring credit health.

Not Checking Your Credit Score

Your credit score is a key determinant in securing favorable loan terms. A good credit score can lead to lower interest rates and more affordable payments. Regularly check your credit report for errors and work on improving your score to get better loan conditions.

Underestimating Credit Score Impact

Many buyers don’t realize how significantly a credit score can influence loan terms. Even a minor improvement in your score can substantially reduce the interest you’ll pay over the life of the loan.

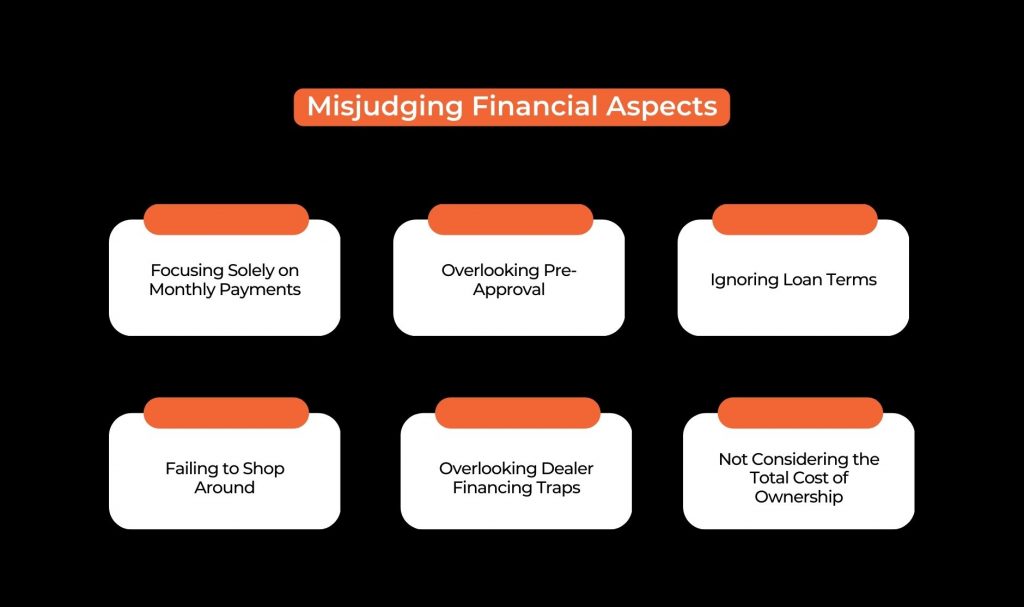

Misjudging Financial Aspects

Another set of mistakes that most car loan takers commit is to misjudging the financial aspect of things. Thiese are some of the mistakes that most people commit.

Focusing Solely on Monthly Payments

Focusing only on monthly payments can be misleading, often leading to longer loan terms and higher overall costs. Evaluate the monthly payment and the total loan cost, including interest and fees, for a balanced financial decision.

Overlooking Pre-Approval

Skipping pre-approval is a common oversight. Pre-approval gives you a clear idea of what you can afford and strengthens your position when negotiating with dealers. It also helps you set a realistic budget.

Ignoring Loan Terms

Understanding all the terms of your loan is crucial. Ensure you know the interest rate, repayment period, and any fees or penalties. Being fully informed can save you from unexpected costs and financial strain.

Failing to Shop Around

Different lenders offer varied rates and terms. Research and compare offers from multiple lenders to find the most advantageous deal for your situation.

Overlooking Dealer Financing Traps

Dealerships might offer convenient financing, but it often comes with hidden fees or higher rates. Always compare these with independent financing options to ensure the best deal.

Not Considering the Total Cost of Ownership

Remember to include all car costs, such as insurance, maintenance, and taxes, in your budget. These expenses can significantly impact your monthly finances.

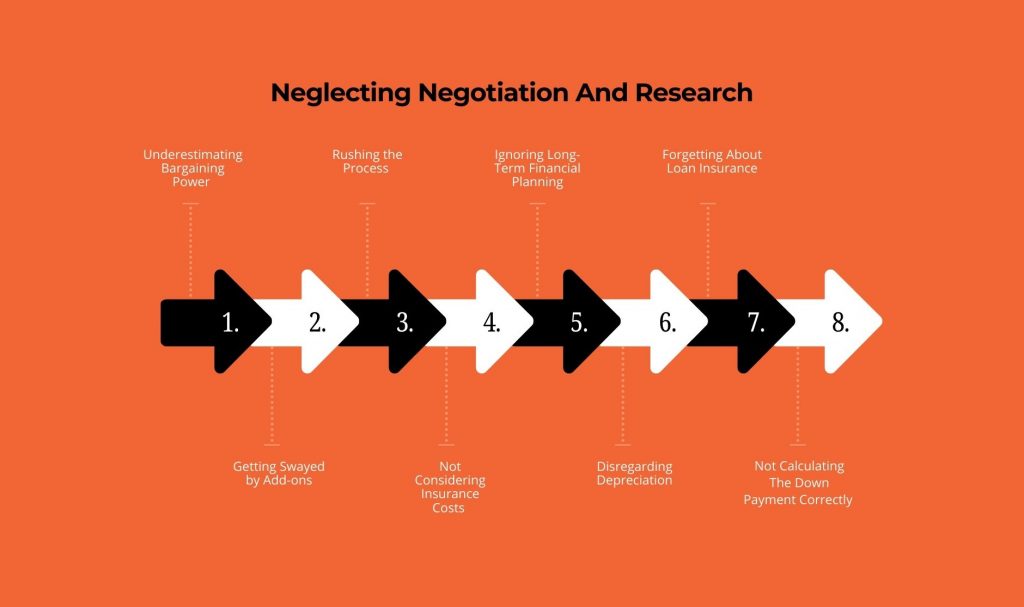

Neglecting Negotiation And Research

Underestimating Bargaining Power

Many buyers accept loan terms as they are presented, not realizing that negotiation is often possible. Engage in discussions with your lender to secure more favorable terms.

Getting Swayed by Add-ons

Dealers often try to include unnecessary add-ons in your financing package. Evaluate the necessity and value of these extras carefully before agreeing to them.

Rushing the Process

Avoid making quick decisions without thorough research. Take your time to understand all aspects of your car loan and avoid making decisions under pressure.

Not Considering Insurance Costs

Insurance premiums can vary based on the car model and your driving profile. Factor these costs into your budget.

Ignoring Long-Term Financial Planning

Your financial situation might change over the term of the loan. Choose a loan that remains manageable even if your circumstances change.

Disregarding Depreciation

Consider the car’s depreciation rate and how it affects the loan’s equity, especially if you plan to trade it.

Forgetting About Loan Insurance

GAP insurance covers the difference between the car’s value and the remaining loan amount in case of total loss. This can be crucial, especially if your down payment is small.

Not Calculating The Down Payment Correctly

Your down payment directly influences the loan amount and interest. A larger down payment can lower your monthly payments and save you interest in the long run.

Overlooking Broader Financial Implications

As a financially conscious individuals, you must approach the topic with some basic clarity on some of the things. Here are things that people generally overlook.

Ignoring Future Financial Goals

Ensure your car loan aligns with your long-term financial goals, such as buying a home or retirement savings.

Not Reading Customer Reviews

Customer reviews can provide valuable insights into a lender’s service quality and reliability.

Dismissing Alternative Financing Options

Explore different financing options, including credit unions, online lenders, and personal loans, which offer more favorable terms.

Overestimating Affordability

Avoid overextending your budget. Choose a loan that fits comfortably within your financial means.

Neglecting Interest Rate Fluctuations

Be aware of market changes and how they affect interest rates, especially for variable-rate loans.

Overlooking Early Repayment Penalties

Some loans include penalties for early repayment. Understand these terms to avoid unexpected charges.

Not Assessing Loan Term Implications

Consider how the length of your loan term affects the total interest paid and your financial flexibility. Shorter terms generally mean higher monthly payments but lower total interest.

Overlooking Total Debt Burden

Consider your overall debt burden when taking on a car loan. Managing excessive debt can impact your ability to secure other loans in the future.

Neglecting To Factor In Fuel Efficiency

Fuel efficiency impacts ongoing vehicle costs. More fuel-efficient cars can offer long-term savings, potentially offsetting higher initial costs.

Ignoring End-of-Term Balloon Payments

Be aware of large balloon payments at the end of some loan terms. Ensure you can afford them or have a plan to refinance if needed.

Missing Out On Seasonal Offers

Watch for special deals or incentives offered by car dealers and lenders during certain times of the year. These opportunities can lead to better loan terms.

Not Considering A Co-Signer

A co-signer can help secure a loan, especially if you have limited credit history or a lower credit score. This can lead to better loan terms but ensure both parties understand the responsibilities.

Overlooking Online Loan Calculators

Utilize online calculator tools that help you to get a clear picture of your potential monthly payments and total loan cost. These tools can help in comparing different loan options and planning your budget.

Ignoring Non-Traditional Lenders

Non-traditional lenders, like peer-to-peer lending platforms, can sometimes offer competitive loan options. Research these alternatives as part of your comprehensive search for the best loan.

Conclusion

Navigating the complexities of car loan options requires careful consideration and informed decision-making. By being aware of these common mistakes and approaching the process diligently, you can secure a loan that fits your financial situation and supports your long-term goals. Stay informed, take your time, and make choices that enhance your financial well-being now and in the future.

Read Also:

Comments Are Closed For This Article