Wagepoint Software Reviews, Pricing, And More – 2023

4 Mins Read

Published on: 26 June 2023

Last Updated on: 14 November 2024

toc impalement

- Wagepoint provides payroll processing for employees and contractors at the same time.

- Employees can access their paystubs, and Wagepoint users can access a friendly and caring customer support network.

- There is a simple, transparent, and easy-to-use pricing calculator that helps you estimate your pricing.

Small businesses looking for a very simplified and user-friendly payroll processing software can use Wagepoint. This platform simplifies and automates all your payroll-related work. It does not matter what type of employees you are working with. Employers can offer payments to salaried employees, contractors, and freelancers.

Wagepoint single-handedly manages the deductions, direct deposits, and other additional information of your employees. They help you handle payroll processing, tax filing, calculating and payments, benefits administration, and more.

But, paying out vacation time is calculated on an hourly basis, not daily – which is a problem for some organizations. But the ultimate question is, is Wagepoint a good payroll service for your business? If you are wondering about that, then go through this article. This review should help.

What Is Wagepoint?

Stay on top of your organization’s payroll taxes with the Wagepoint payroll. Wagepoint offers payroll services to small businesses. The payroll processes are very simple, smooth, and easy. Employers can pay salaried contractors and freelancers. They can pay directly to the bank accounts of their employees.

Their helpful payroll processing service is famous and used among more than 22000 small businesses worldwide. Users can keep their payroll taxes on cruise control. They offer automated tax filing, tax calculation, and payment features.

Also, the learning curve on this platform does not feel like bone-aching is difficult. There are built-in tips and tricks to help the users to become habituated to their features. You can reroute new clients, use automatic deposits, get customer reviews, and reduce employment and payroll processing costs. More so, the website’s interface is intuitive and easy to use.

Wagepoint Features

You will find the best answers, whether it is processing payroll or monitoring employee salaries.

Payroll Processing

The Wagepoint payroll processing platform allows you to review the payroll details of each of the employees at a glance. Employers can process payroll for contractors, salaried, and freelance employees. You can create playgroups for employees and their payment processing. Users can process payments based on waged hourly employees and salaried ones.

Tax Filing And Reporting

Wagepoint is good enough for calculating taxes and filing taxes. This payroll processing software will submit taxes on behalf of the company. Wave Payroll also generates W-2s and 1099s automatically at the end of the year. While doing so, it can also file them with the IRS. There is an online payroll portal accessible to both the employees and the employers, and they can review their year-end documents.

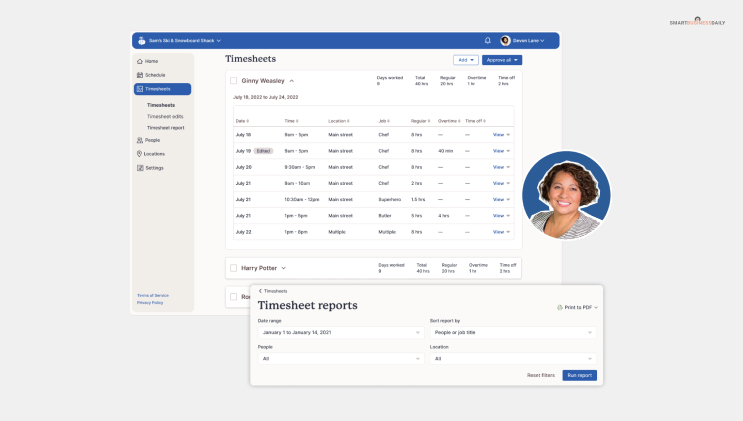

Employee Hours Tracking

Many employers have to often rely on manual processes for employee time tracking. Time tracking helps measure the pay each employee deserves for their time inside the organization.

However, many organizations rely on spreadsheets, paper sign-in sheets, or emails. But thanks to Wagepoint, you can record the clock-in and the clock-out time of the employees and measure their performances. This allows organizations to process the right payment for the right employees.

Online Paystub Access

Employees do not have to rely on paper-based paystubs anymore. Thanks to Wagepoint, now they can get access to online paystubs. They can get access to their paystub information from anywhere.

Employees enrolled in the Wagepoint payroll system will be able to access their paystubs on their own. However, it will require more and more things on their part. This is one way of saving employers time and reducing organizational inefficiencies.

Pros And Cons Of Wagepoint

Here are some of the pros and cons of the Wagepoint profile.

Pros

- Intuitive and useful automated payroll processing software.

- The customer service is very responsive and useful.

- The pricing plans are transparent and affordable for small businesses.

- Employees can access their paystubs online.

- Users can import hours and earnings through CVS.

- Employees can have more than one job.

- On top of all, the user interface of the platform is very straightforward and responsive.

Cons

- Some users think that the Wagepoint payroll processing software is a little clunky for paying out vacation times.

- There is no free trial option available.

- Wagepoint does not integrate with the employee healthcare system.

- There are much better options like Wave Payroll or Gusto Payroll available.

- The payroll service offered by this platform is only suitable for small organizations. Large and multinational platforms will not benefit much from them.

Wagepoint Payroll Pricing

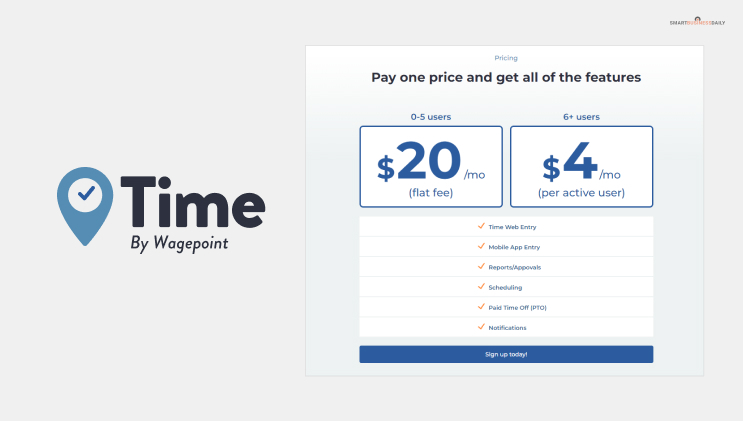

If you are thinking of an affordable payroll service providing software, then Wagepoint is one of the best ones you will get. The core plan is billed at $20/month and $4/employee. There is a pricing calculator that allows users to measure their pricing plans.

Users simply have to enter the number of employees they want to process payroll for and their subscription renewal period. There are monthly, weekly, biweekly, and semi-monthly plans the users can choose from.

Core Features: The core plan offers employees and contractors direct deposit options. The core plan also offers an online portal for employees to check their own paystubs. The tool also offers the T4 & T4As reporting. The payment calculator is very simple to use as well.

Bottom Line

The official website of Wagepoint claims that the user has to pay only one price to get all the features they have mentioned on the platform website. Also, employers can really benefit from the different payroll periods they can select using wage points. They have a 4.7/5 rating on Trustpilot and more than 22000 trusted users.

Additional Resources:

Comments Are Closed For This Article